Submitted by Infamous_Sympathy_91 t3_10p7ljx in wallstreetbets

Comments

VisualMod t1_j6ipg6q wrote

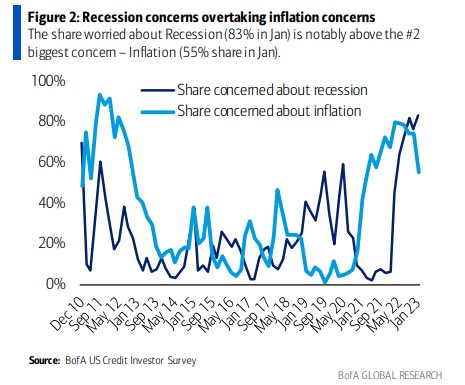

This is an interesting data point. It seems that people are more worried about a potential recession than they are about inflation. This could be due to a number of factors, but it's definitely something worth paying attention to.

^^Discord ^^BanBets ^^VoteBot ^^FAQ ^^Leaderboard ^^- ^^Keep_VM_Alive

Ok_Edge_1486 t1_j6is61w wrote

Inflation is certainly something the FED can fight and beat. But how much damage can be done to the market is another matter altogether... 50 BPS to show biden is commited to fighting to inflation, 25 BPS to show he's trying to be a centralist. Either way though, 50 bps seems locked in to me...

Remarkable_World_351 t1_j6itby4 wrote

Biden (or any sitting president) has absolutely zero to do with interest rates

Shoopdawoop993 t1_j6itus9 wrote

Could the x axis be any less useful?

Ok_Edge_1486 t1_j6itvxt wrote

You're forgetting the fact that the president has the complete right to hire and fire Federal Reserve Chairmen. In a way, the will of the President is executed through the chairmen. Of course I don't think Biden cares at all about the stock market and is more concerned with increasing wage gains and increasing jobs.

CropDuster921 t1_j6iuqrw wrote

I’d argue we’re in a recession with all these layoffs. Albeit a recession that’s normalizing the workforce after that unreasonable post COVID boost

neg_meat_popsicle t1_j6ixnac wrote

What about inflation? Do you agree that higher energy costs cause inflation?

Turbiedurb t1_j6ixx6m wrote

That's resonable imo.

iPigman t1_j6j17td wrote

When the Media pounds the Recession drum; what would expect?

Trpdoc t1_j6j2lb9 wrote

whats it normalizing tho, how the hell do people still have so much damn money to buy a fast food chicken sandwich for like $13

Zzirg t1_j6j3m0w wrote

They dont, cC debt is exploding for the avg american

Trpdoc t1_j6j42ig wrote

We always talk about cc debt exploding but nothing ever comes of it. Why the hell are prices not coming down at all it’s getting ridiculous.

minhthemaster t1_j6j4nrx wrote

What a bunch of random ass months

[deleted] t1_j6j57e7 wrote

[deleted]

MoneyForPussy t1_j6j60zh wrote

the cc company just gets bailed out by tax payers of course they don't want to remind ppl of that

Trpdoc t1_j6j6hzx wrote

This happens often?

MoneyForPussy t1_j6j6ndo wrote

higher energy cost should result in lower energy consumption as service gets shut off due to nonpayment at some point

MoneyForPussy t1_j6j79fh wrote

only if the cc company goes belly-up from too many ppl not paying...most unpaid cc debt goes paid by tax payers & it doesn't get mentioned bc they assume most folks will get upset & just max out their cc's then never pay it

Explod3 t1_j6j83et wrote

Yes. Going from i have a job but not enough money, to I have no job and no money is better

neg_meat_popsicle t1_j6jddlo wrote

What about logistic costs due to energy?

Zzirg t1_j6jdx2k wrote

Takes time to reach a breaking point. Will we get there? Idk time will tell

[deleted] t1_j6jltuf wrote

[deleted]

MoneyForPussy t1_j6jlx7e wrote

crumbaker t1_j6jlyin wrote

It takes time for the negative effects to happen. It's really started to soar within the last 4 months or so. We're starting to see raising defaults on car loans uptick quite a bit. I'd expect to see the same thing with other forms of loans/credit within the next 6 months.

Trpdoc t1_j6jo61e wrote

I’m just annoyed a fast food level chicken sandwich is 13 and rising. No end in sight.

BobRussRelick t1_j6jq4r4 wrote

maybe for the pajama class who are beginning to realize this will be a white collar recession

yo_agamemnon t1_j6jqax7 wrote

each dot is either eight or nine months (alternating) after the previous dot, so after the initial starting point you only have three months (January, September, May) on the X axis

SmokyDragonDish t1_j6js4td wrote

How about both?

renok_archnmy t1_j6jy1d4 wrote

Brought to you by some weeaboo obsessed with using ChatGPT to make BI charts so they don’t have to interact with real humans at work.

renok_archnmy t1_j6jy51h wrote

Credit cards

renok_archnmy t1_j6jycnn wrote

Availability of currency can drive inflation. The total CC debt doesn’t affect much. The ability to swipe it for more spend when the sand which is now $5 more than it was last month is what props it up.

bahkins313 t1_j6jye21 wrote

It’s funny, but not surprising, no one here thinks there’s a reason to divide the year into 4 to report financial data

renok_archnmy t1_j6jyols wrote

Underwriters carry insurance against loan default. They can write off the losses, make a claim, recoup funds, hold them in suspense type GLs as various losses for accounting trickery over the years.

Having a loan go bad for a bank isn’t a black and white affair of money lost forever. They get it back.

It happens all day every day.

renok_archnmy t1_j6jyw2h wrote

Ehh, the underwriter will sell the debts before that happens. There’s also insurance.

If they just sat back and did nothing, yeah they’ll go out of business. But they aren’t in the business of going out of business.

Trpdoc t1_j6jz3ra wrote

And that comes to pass well never. When was the last time you ever ever saw prices actually go down substantively. That fucking sandwich should be $8-9 max. And now everything 14-15 is just normal.ohhhhhh and don’t forget tip!!!!

renok_archnmy t1_j6jz62q wrote

My employer has been seeing all loan misses and defaults ride for months now, not just cars.

Trpdoc t1_j6jz7y6 wrote

That’s what I’m saying then. Nothing is going to change, prices aren’t coming back down no fucking chance.

iloveeveryone2020 t1_j6jzeof wrote

They're pounding the, "pls, Daddy, print me that reversal"

[deleted] t1_j6jzqs3 wrote

[removed]

Rude_Present_6352 t1_j6k0tjm wrote

2023 will be a year of foreclosures, bankruptcies and layoffs.

renok_archnmy t1_j6k0wi3 wrote

When I was 16 you could buy a hamburger at McDonald’s for $0.89 on Tuesdays.

Not 100% following your reply, but prices rise because people pay them. They can pay them because they can put them on credit. Right now there is a tinge of hope this shot passes and their incomes might increase and stock markets return to COVID valuations. They won’t, there’ll be defaults, prices of goods will remain high, more people will become poor, rich people will become more rich. Same as happens the last few times this happened.

If you don’t like spending whatever McDonald’s charges for a hamburger today because you could buy one in high school for next a dollar, then don’t buy McDonald’s hamburgers.

renok_archnmy t1_j6k1b0l wrote

No they aren’t. I don’t get the feeling anyone thinks they are (except for some of the children on here who only started paying attention during COVID).

wealth4good t1_j6k9ifj wrote

"There are three kinds of lies: lies, damned lies, and statistics" - Benjamin Disraeli, the 19th century British Prime Minister

MoneyForPussy t1_j6kihfp wrote

very good point did not consider that.... they prob know other lenders with deep pockets & can sell to another creditor who can afford to take on the risk too which would avoid having to make any claims

Ant0n61 t1_j6kiqgi wrote

Just a matter of time before WWIII or another pandemic take the lead! Stay tuned folks, the doom and gloom business never runs out of material!

MoneyForPussy t1_j6kk95j wrote

i think it's a little more complex...seems that as prices of essential goods/services continue to rise, people will tend to compensate by purchasing less non-essential stuffs (or none at all)

renok_archnmy t1_j6kl8am wrote

Just sell it down until it settles somewhere with efficient collections divisions or easy to claim insurance.

We had to offload and cut off a lot of high risk debts we were buying because our insurance was harder to tap than previous projected. The margin was getting eaten up on operations expenses making the claims as they defaulted. Essentially, we stood to profit even in default except that the hourly wage of the staff processing the default, the lag time from default to paperwork, and the cost file the claims made it less profitable than other options.

renok_archnmy t1_j6km3k8 wrote

This does happen. But often the cost to produce a luxury good is not far off from a standard one. Eventually demand drives up register price of regular products too. It’s like in the 90s Airwalks were the hot shit for a minute and vans were practically knockoff. Tables can turn. My dad bought a brand spanking new bare bones f150 in the 90s for $9000. Now pickup trucks are minimum $40k and have all sorts of amenities people back then didn’t even want in a work vehicle. Coupes were once the sport cars for people who didn’t need a full fledged sports car (or couldn’t afford one). Now people are buying high horsepower sedans and treating them like sports coupes.

Trpdoc t1_j6kn2vr wrote

The point was how the hell are people affording these prices. Ok let’s say it’s bc people will default on their credit cards and that’s the reason which you all claim. Then how does any rebalancing occur. All these people plan to just default on their cards bc they want to buy $13 fried chicken sandwich

Trpdoc t1_j6knbrr wrote

Airwalks and eggs/chicken are different bro.

Trpdoc t1_j6kosa1 wrote

Well people are straight fucked not gonna lie.

MoneyForPussy t1_j6kpi01 wrote

i would say prices of new cars have mostly remained fairly flat when compared to wages though, i remember my old man paid $15k for a manual trans 2000 Honda civic ex coupe brand new (which i would definitely not consider to be a sports car even though insurance classified it that way)

i saw a 2023 nissan the other day (also 5 speed manual trans) but while it was the base model sedan, i would bet the car is at least 10 times nicer than that civic was - for only $15k as well, which would probably be about 1/3 the price of that civic when adjusted for inflation

many folks would take that over a $50k camry even if it means they have to learn to drive a stick shift. but from what i understand, many car dealers are hiking prices in order to produce less cars & manage less inventory but maintain the same bottom line, and maybe that makes sense if the shift to EV accelerates, or maybe they will fall short. anyone's guess i suppose

Hacking_the_Gibson t1_j6krxdf wrote

The Fed chair serves at the pleasure of the Senate, not the POTUS.

That’s why Donnie going on Twitter complaining that Powell was raising rates in 2018 was so unprecedented.

renok_archnmy t1_j6kt7l1 wrote

Not sure they’re planning anything. They want chicken sandwich, chicken sandwich is $14, they whip out that visa and charge it because bank account balance is $10.

6-12 months later they’ve maxxed out the credit card, can’t afford chicken sandwiches anymore and can’t afford the payments. Now they’re fucked.

It’s rebalanced in bankruptcy court, collections departments, insurance carried by the banks, debt settlements, you name it. They could’ve eaten beans and rice all year and not been in the spot. Instead they traded future credit worthiness for a chicken sandwich.

It’s literally that simple. Banks insure against this kind of loss and sell off bad loans all the time. Those get utilized for various things to avoid taxes or whatever over time. Interest rates climb. Taxes climb. That’s where it gets balanced back out.

I wouldn’t sweat it too much. Just Americans spending irresponsibly driven by consumerist lifestyles.

renok_archnmy t1_j6ktwve wrote

I was just trying to make the point that what is a luxury hood today may not be in years to come. What might be cheap basic thing today may become a luxury good tomorrow.

MoneyForPussy t1_j6kuf6a wrote

i definitely would not have foreseen n64 games selling for $500-1k that's for sure

renok_archnmy t1_j6kv4xw wrote

MTG cards, comic cards from the 80s, my wrecked gen 1 turbo 4g63 with no crank walk eclipse and manual 5 speed, so many things mooned after I sold them.

Trpdoc t1_j6kweyh wrote

Not sweating it. Just don’t want to pay $14-20 for chix sando any more

renok_archnmy t1_j6kxyp7 wrote

I hear ya. 10 years ago I could eat for $2/meal healthily. Now it’s $10/meal. By 2033 it’ll be $50/meal.

[deleted] t1_j6lcq1f wrote

[deleted]

Raginghemorrhoids t1_j6lcz87 wrote

Pnotebluechip t1_j6ld24d wrote

Seems like certain sectors are in a recession. Others are booming. I wonder if the growth from onshoring, oil and gas industry, the need for better infrastructure and more housing offsets the drop in tech. The defense industry should boom as Ukraine uses up supplies. Strong growth vs over leveraged economy feeling the burden of higher carrying costs. It's like the rumble in the jungle baby!

Subject_Way_2409 t1_j6n1sl5 wrote

People are hitting credit card maxes soon, it is coming.

VisualMod t1_j6ipfk2 wrote

^^Discord ^^BanBets ^^VoteBot ^^FAQ ^^Leaderboard ^^- ^^Keep_VM_Alive