Comments

mattgm1995 t1_jdwr6vh wrote

Totally makes sense. Why would someone want to trade a 2.5% mortgage for a 7% mortgage?

[deleted] OP t1_jdwsw5r wrote

Absolutely. We were always headed for an issue with a housing shortage in the region. But artificially suppressed interest rates caused by the Fed gobbling up Mortgage Backed Securities, and the pandemic changing how people viewed/valued homes caused it to happen over the span of 2 years rather than a decade.

[deleted] OP t1_jdwt8hi wrote

According to housing bubble doomers, the high mortgage rates were going to tank the housing market. A massive recession was going to cause everyone to be laid off and there would be a flood of inventory. Turns out supply was destroyed more quickly than demand, and there's a lot of robust earners in this state that can still comfortably purchase homes despite current rates.

WinsingtonIII t1_jdwtm24 wrote

I mean, I agree it's a massive issue, but I don't really understand how you are coming to the conclusion that building more housing is a bad thing in this context.

Not building more housing just makes the huge problem even worse. Waiting 25 years until the Baby Boom generation dies off while not building any housing right now isn't really a "solution."

Obviously developers build to make money. Building more housing is still preferable to not building more housing when there is a severe housing supply/demand mismatch.

[deleted] OP t1_jdwugcg wrote

[deleted]

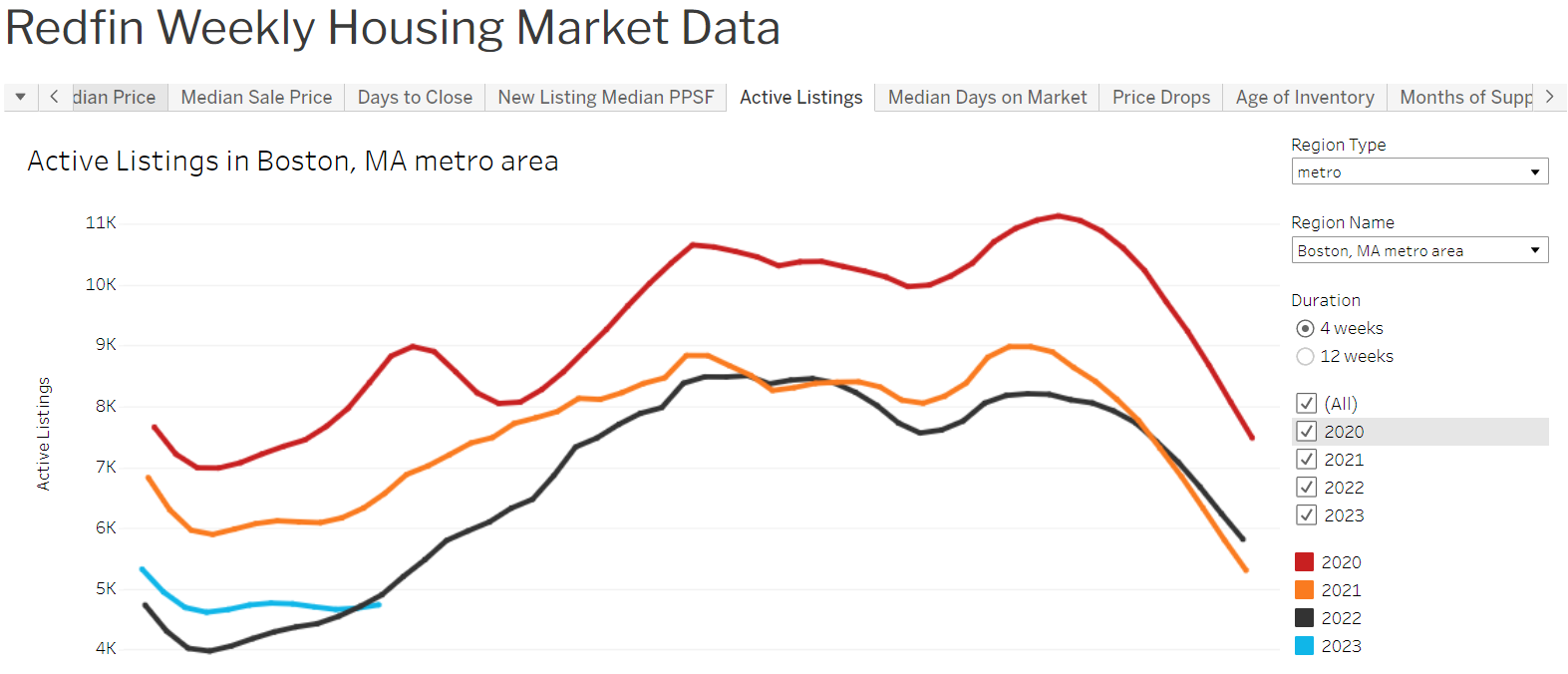

JPenniman t1_jdwv27u wrote

Wish there was an x axis showing time. Looks as bad as 2022 was so far.

[deleted] OP t1_jdwwbbq wrote

Yeah there's no axis but the width of the graph is just one calendar year. The most recent data point for 2023 was the week ending 3/19.

It's going to be worse than 2022, because new listings are down 24% year-over-year.

mattgm1995 t1_jdwwvy8 wrote

For context my wife and I are $180k in HHI and we can’t afford a home where we want. 3 beds and 2 baths are $450k +. It’s insane

[deleted] OP t1_jdwzg7v wrote

Your main issue is that you're trying to buy a home that's 2.5x your income, that's pretty conservative. A lot of people do 4-5x, whatever the max the bank will loan them. So in some cases you're losing houses to people who make less money but willing to spend more on the mortgage. I'm not telling you to spend more than you're comfortable with, just putting into perspective what some people around here will do to get a home.

$450k is entry-level now, it's actually the most competitive market segment due to high demand from first time buyers, but also extremely low supply (people with low mortgage rates are stuck in their starter homes and can't move up without incurring a massively bigger payment).

whoeve t1_jdx02z8 wrote

Even in the places I don't want I still can't afford a home without it needing lots of work. Houses are just straight up 50% more expensive compared to pre-pandemic. My income certainly ain't up by that amount.

OralHairyLeukoplakia t1_jdx82yh wrote

Fewer*

[deleted] OP t1_jdx9h2m wrote

So would it be "I give less than zero fucks" or "I give fewer than zero fucks"?

mattgm1995 t1_jdxaauv wrote

I don’t think the fact that I’m not willing to overextend and jeopardize my retirement savings is the issue… supply is the issue.

[deleted] OP t1_jdxcxqe wrote

Even the old “boomer rule” of 28/36 resulted in spending a little over 3x household income on a home. So yes you’re thinking quite conservatively. Not a bad thing, but it’s not going to get you anywhere in today’s housing market. I don’t realistically see a path forward to increasing supply in Greater Boston.

Outrageous_Map3458 t1_jdxfjl5 wrote

Yes, and the real estate agents are already sending spam calls and texts.

HistoricalBridge7 t1_jdxgemm wrote

I saw a statistic that something like 98% of homeowners (with and without a mortgage) have rates under current levels of 7%. So most people ain’t incentivized to sell.

Outrageous_Map3458 t1_jdxi9x3 wrote

Because people get forced to sell eventually. Divorce, death or moving for a job.

Hottakesincoming t1_jdxier9 wrote

It really depends on the area. Sale prices on houses in my admittedly less desirable neighborhood are only up 20%, maybe 25% from 2019, but that's not actually far off from inflation. It's mortgage rates that have really raised the cost of owning a home, combined with inflation way outpacing salaries.

[deleted] OP t1_jdxl6fd wrote

That's the level of inventory you're seeing on the market now. Ain't much.

Itchy-Marionberry-62 t1_jdxlltr wrote

Hyper inflation interest rates and the large number of people wanting to leave the state is probably the big reasons.

[deleted] OP t1_jdxn0kp wrote

[deleted]

sad0panda t1_jdxob4w wrote

*fewer

dcgrey t1_jdxqfda wrote

The country's population fundamentals are part of all that too. For housing developers, there's every incentive to choose to build pricey houses because there are still plenty of people buying them.

I saw this recently in a city in the south. Dozens of recently built (<20 years old) developments, each with a hundred or so houses...and none of them affordable on an average income, because there were always plenty of above-average earners ready to buy them.

ImProbablyHiking t1_jdxvrns wrote

Someone who can buy cash with the proceeds

pillbinge t1_jdxw6kr wrote

It would be the latter, but it doesn't make sense, since you took the time to respond.

aSadEconBoi t1_jdxwvvw wrote

I have a feeling you have a very tenuous grasp of how your employer projects returns for potential developments. The short version of the story is just that there is so much demand that whatever additional units we build aren't going to immediately result in drastically lower housing prices, but it's still a step in the right direction. There is no overnight solution to a problem of this magnitude.

UltravioletClearance t1_jdxy280 wrote

Out of everyone I know who bought a home in the past 30 years, almost all of them purchased more than they could afford according to dated "rules of thumb." The dirty little secret is you either need to be filthy rich or "house poor" to own in this state. It's been that way for many years.

amos106 t1_jdy0m3s wrote

Developers don't build affordable housing but that doesn't mean that "luxury" units don't provide pressure relief from gentrification. The road infrastructure isn't scalable for single family housing. Right now the best solution is to build 5-over-1's near public transit and hope that the market can sort itself out over time.

meltyourtv t1_jdy0u5z wrote

My roommate listed his condo we lived in 1st week of February. Sold in 5 days all cash, closed in 20 days. Makes sense now

amos106 t1_jdy1qaw wrote

So is the recession over? It was only like 2 weeks ago that a major bank in the tech industry went belly up and had to be bailed out. Said bank was bailed out because it was used by many startups (including local ones) for payroll. More companies are announcing layoffs too. Lots of conditions in the market are changing at the same time and it will take a bit for the dust to settle.

Unfair_Isopod534 t1_jdy5cjg wrote

Not surprised at all. Each house gets at least 10 offers, gets sold within a week. Forget about any contingencies. I was at an open house with a line of people. If you are 5 min early to open house, you gotta look for parking. If you think you got money, there is someone else with more money. It's just sad.

A_Ahai t1_jdyg7q5 wrote

Easy there Stanis

ksoops t1_jdymlhr wrote

And the majority of outstanding mortgages are under 3%. Everyone and their mom refinanced in 20-21.

aime10123 t1_jdypstk wrote

Where are you looking? 3 beds 2 bath is closer to 600k where I'm looking

mattgm1995 t1_jdytiok wrote

Yep same vibes. Georgetown / rowley

Shnikes t1_jdywgnb wrote

They choosing to rent now? I’m curious to what people are doing after they sell. My sister-in/law just sold her condo but now has to live with her in-laws.

DrNostrand t1_jdzkos1 wrote

this is the way, make sure the home checks some boxes for when you go to sell "decent schools,close to commuter roads/rails, decent garage" and youll make your money back.

[deleted] OP t1_je01l45 wrote

[deleted]

elykl12 t1_je02vir wrote

The house is his, by right. All those who deny that claim are his foes

meltyourtv t1_je03jwo wrote

Moved back in with their parents while they try to find a short term rental with their s/o, which they cannot so far

Anthraxkix t1_je0pjbj wrote

The pic you posted shows there being fewer in early 2022.

Whitey3752 t1_je0xqap wrote

I am not one of those who can comfortably afford anything in mass. Single dad of 2 (now) adults, no wife and looking for a 1-2 bedroom for $300K. Anything in that price range is pretty much non existent. Renting is nuts and you might as well have a mortgage but either way its incredibly tough to buy anything on your own. Depressing as hell as I need to leave my apartment since my building got bought out and my rent went up $1200. I feel pretty fucked either way.

TiredPistachio t1_je1093h wrote

3x isnt over extending yourself.

mattgm1995 t1_je10id5 wrote

Eh with student loans and 7% rates with PMI it is.

newestJourney t1_je2lpmz wrote

fucking sucks.

totemlight t1_je7r0ff wrote

Prices are down 2-3 percent since last year, imho gonna get better.

snoogins355 t1_jefrkk7 wrote

I mean we'll see in 6 months to a year

[deleted] OP t1_jdwq5nt wrote

[deleted]