Submitted by IncomeStatementGuy t3_10q32zy in dataisbeautiful

Comments

IncomeStatementGuy OP t1_j6oft9b wrote

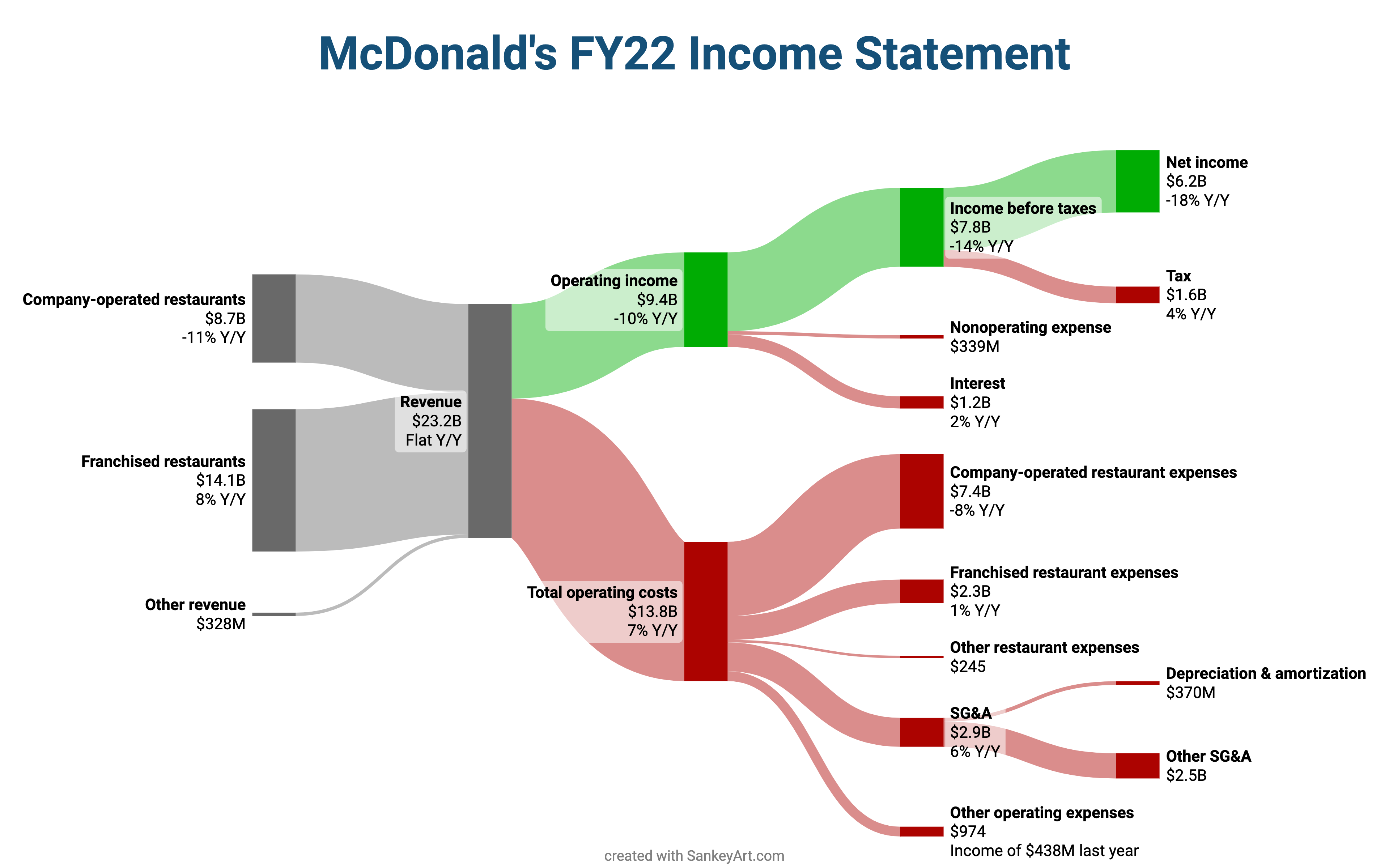

Looks like a 15% margin on McDonald's Corporation-operated restaurants but an 84% margin on franchises. Astonishing. Didn't realize that when I created the diagram.

currentscurrents t1_j6pf3yq wrote

Of course, that's not the same as the actual profit margin of the restaurant - that's just what McDonald's corporate makes from the franchise vs the costs of what they provide to the franchise.

ialghamdi1 t1_j6p5l63 wrote

Is it because of the new AI assisted operation we see now in the states?

Salty_Employee_8944 t1_j6p8p0b wrote

Nah, it's because the franchisees pay for every cost. McDonalds leases the land for them and collects the franchise fees, royalties. It's essentially free money for the company.

When they operate the restaurants there is costs of buying the ingredients, paying the employees etc. And the revenue comes from the burger sales.

On the franchise part the revenue is from the fees, so of course there's not much cost to that. I don't think the burger sales from the franchises even show up on the income statement, that's the franchisees revenue, not the company's

currentscurrents t1_j6pfewg wrote

Those are overhyped. They haven't automated the actual cooking - just replaced the cashier with a touchscreen. Fully automated restaurants remain a dream.

debunk_this_12 t1_j6opehr wrote

One critique. It’s EBITDA, not income before taxes also u need to add depreciation they didn’t pay 4% in taxes.

IncomeStatementGuy OP t1_j6otsjf wrote

>https://www.sec.gov/Archives/edgar/data/63908/000006390823000005/exhibit991-123122.htm

Thanks! But I think my terms are right.

I structured the visualization similarly to the structure of McDonald's income statement: https://www.sec.gov/Archives/edgar/data/63908/000006390823000005/exhibit991-123122.htm

Only difference is that I abbreviated their reported "income before provision for income taxes" as "income before taxes".

Depreciation is reported as part of their operating expenses.

kchro005 t1_j6oolu6 wrote

This diagram looks like the cables in my pc

IncomeStatementGuy OP t1_j6op587 wrote

Is your PC profitable?

IncomeStatementGuy OP t1_j6ni5hk wrote

- Data source: McDonald's SEC Filing, https://www.sec.gov/Archives/edgar/data/63908/000006390823000005/exhibit991-123122.htm

- Tool I used to create the diagram: SankeyArt (I am the developer of the tool)

Salty_Employee_8944 t1_j6oao95 wrote

Will it support automatic diagram creation from filings in the future? Like you only have to type in the company name and it fills out the cells

IncomeStatementGuy OP t1_j6ognho wrote

Yes, that's on the feature list. I already played around with the official SEC API a bit but ran into issues.

In the meantime, I just create them manually :D

I currently only show links to 10 of them on the website. I need to adapt the UI to make all of them easy to discover...

tasnas123 t1_j6njplt wrote

Is teh software free?

IncomeStatementGuy OP t1_j6nkoig wrote

It's teh freemium. Diagram creation and diagram download are free.

Saving on the server and removing the little watermark at the bottom requires a subscription.

tasnas123 t1_j6nu1wh wrote

That's good, I will download to use it.

I like analysing stocks this way even more.

IncomeStatementGuy OP t1_j6o1kej wrote

Happy to hear that - no need to download the software though. It's a web app (a link is in my profile, I don't want to post it here to self-promote too much).

NiemandDaar t1_j6ph7jm wrote

A bit weird, isn’t it? It’s like showing how much GM makes by showing what the dealerships make instead of what they make from producing cars.

Salty_Employee_8944 t1_j6o9pc0 wrote

Damn. Look how much lower the operating margin is on the operated restaurants vs on the franchises. It makes sense, but cool to see it like this