Submitted by Ill_Fisherman8352 t3_zrnjbo in dataisbeautiful

Comments

Ill_Fisherman8352 OP t1_j14119q wrote

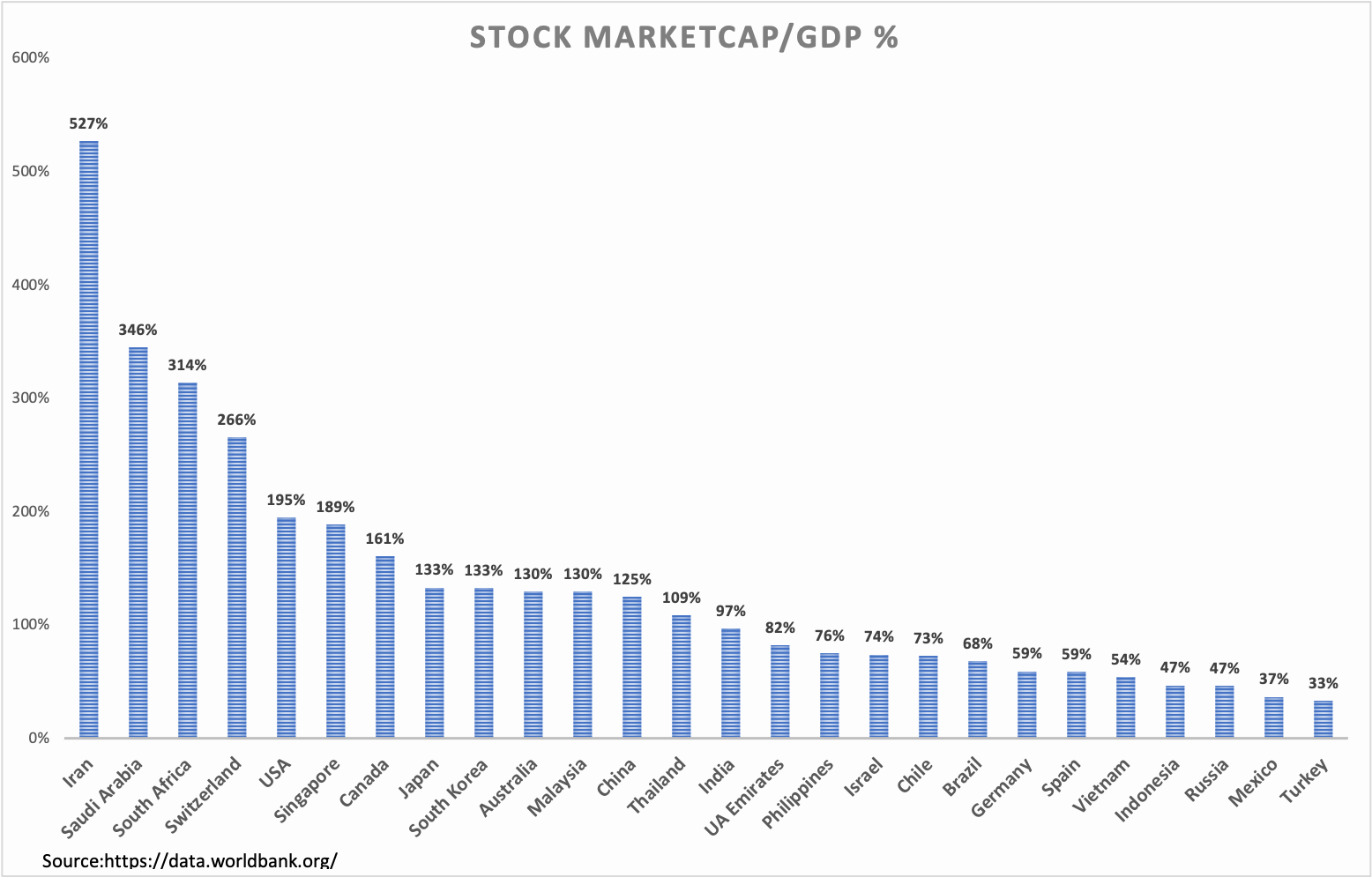

Yes above 110% is usually considered overvalued and stock markets can mean revert. US was at 195% in the chart , now its somewhere around 130%. Its better to be below 110% for sustainability.

_CHIFFRE t1_j151epd wrote

Data for Iran is likely untrue, stock market capitalization is around $1.3 Trillion (Ceic data), so according to this graph the GDP is around $250 Billion and in terms of GDP per capita it would be around $2900, far below Iraq where it's over $7000. 2900 is around the average for african countries. The GDP is prob. around 500bn to 700bn.

unfortunately there are different figures that cause confusion, IMF says 2 Trillion but they go by the official exchange rate but the real exchange rate is much worse, but anyway, no way Iran would have a GDP of 2 Trillion anyway, World Bank says 230bn in 2020 which is also ''no way'' territory. UN in 2020 says 940bn, that's more likely but i don't believe Iran's would be higher than Turkey (850bn), both have a similar population, 86.5m in Iran, 85m in Turkey.

World Bank also claimed Iran's GDP PPP in 2020 (Purchase Power Parity) is 5.74x higher than Nominal, at 1.33 Trillion, even in the country with the highest PPP to Nominal Gap, Sudan, it's just 4.85x higher but in Sudan it makes sense as GDP per capita nominal is very low at $920.

AftyOfTheUK t1_j15asq5 wrote

Wouldn't this ratio be highly affected by the ratio of publicly-traded versus privately traded companies?

What does this figure tell us?

If several large companies were to IPO, then the ratio would rise rapidly, but little would have changed within those companies or the country. Similarly, if a number of large companies had management buyouts with private equity, again the ratio would drop - but those companies would continue to operate with the same staff doing the same things.

Not sure what conclusions we can draw from this data?

redditseddit4u t1_j17w5oj wrote

It’s an interesting stat but using it to interpret ‘good’ or ‘bad’ is a big leap given public companies on stock exchanges are mostly international/global companies. For example in the case of Switzerland or Singapore, all their large public companies are multinationals - so the fact that their combined market cap is higher than GDP doesn’t mean much in terms of good/bad.

libertysailor t1_j1kzrug wrote

What is that 110% rule of thumb based on?

Darrow723 t1_j1pshtw wrote

I don't know.

Markymarcouscous t1_j13w3fw wrote

Does this stat mean anything though? Like. Is it better to have more or less or the middle