Comments

neurodiverseotter t1_j0yhhio wrote

Ist this just AA or does it include their subsidiaries as well?

A lot of companies rent space, tools or vehicles from their own subsidiaries to artificially reduce net profit and save taxes.

Also, is there no marketing in the budget or is it included in the "other" section?

[deleted] t1_j0yi1uj wrote

[deleted]

dinosuitgirl t1_j0yjf31 wrote

Would love to see salaries broken down into corporate and operational 🤔

tilapios t1_j0yjmxd wrote

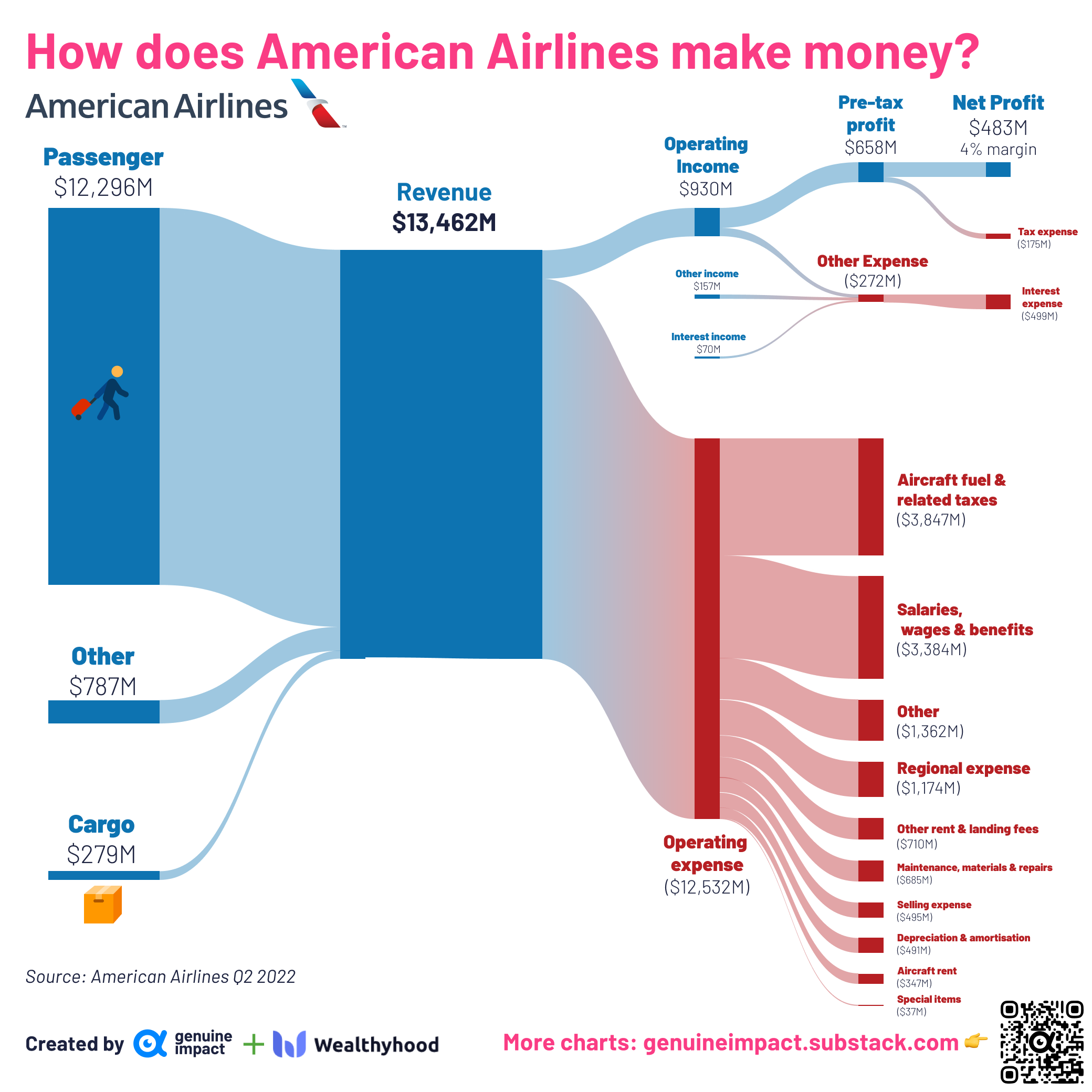

If the numbers are from Item 1A in the filing, the passenger operating revenue should be $12,396 M instead of $12,296 M.

BoredGeek1996 t1_j0yky1v wrote

If automation can reduce salaries, it would be the logical direction to take from a profitability perspective. The whole sector is ripe for automation, from cabin crews to customer service staff. And people wonder why birthrates are declining. We live in times where employees can easily lose their incomes.

[deleted] t1_j0yndlp wrote

[removed]

nprtzcmucbiulfaojf t1_j0yraxi wrote

airlines make most of the money by essentially being banks https://youtu.be/ggUduBmvQ_4

Obvious_Chapter2082 t1_j0ywvil wrote

This is their consolidated income statement, so it includes all subsidiaries.

Obvious_Chapter2082 t1_j0ywxuu wrote

Which channels are remaining? This shows all of their income and expenses

isocrackate t1_j0z375r wrote

FYI - any public company financials are consolidated (all-inclusive of subsidiaries) unless their % ownership is below a certain level. I think under 50%, been a while for me.

eva01beast t1_j0z6jse wrote

This must be the third airline post I've seen by you and all I can conclude is that either there isn't much money in operating airlines, or these companies are indulging in Hollywood levels of accounting.

underlander t1_j0zhnqp wrote

why are the anchor points different widths

[deleted] t1_j0zi4h4 wrote

pk10534 t1_j0zo8mw wrote

There really just isn’t that much money in the airline industry. It’s just expensive any way you look at it, from landing fees to repainting planes to fuel costs to plane orders…it’s an industry that operates on a very thin margin. Airlines can make more money selling miles and loyalty points to companies like Amex or Hertz than they can flying people in economy. And without first class or business class subsidizing the rest of the plane, prices would skyrocket or most airlines would have to go bankrupt.

Obvious_Chapter2082 t1_j0zqiqg wrote

You’re correct, it’s 50%. As long as it’s above 20% though, their share of income would be reported here, it just wouldn’t be through consolidation

Obvious_Chapter2082 t1_j0zqwdt wrote

Most of them do operate on small margins, it’s why they’re one of the first industries bailed out during recessions. But they also have a lot of fixed assets, so they report a lot of non-cash expenses through depreciation

Followthelight86 t1_j0zvf00 wrote

Sounds like they need to stop charging for bags.

vicvinegarboiling t1_j0zvqsd wrote

The corporate side of it would barely be worth showing on this chart. Major airlines have a heavily unionized workforce with over 100k employees. The highest paid employees by far, other than the most senior execs, are pilots. Pilots, especially mainline pilots, get paid very well and have extremely strong unions. I’d say about half of the total salary line goes to pilots. Then the rest will be spread between flight attendants, mechanics, ground crew etc. a small portion will be corporate but it is definitely not the industry to be in if you are looking for large corporate salaries, and given the size of corporate employees compared to the entire org it is a small fraction of the total payroll of the business.

[deleted] t1_j10fa9o wrote

[deleted]

theftnssgrmpcrtst t1_j10ge40 wrote

Honestly way slimmer margin than I expected - is that typical for airlines or is this a post-COVID thing?

Bobson_P_Dugnutt t1_j10kgx1 wrote

What this graph doesn't make explicit is that AA, like other American airlines, is only profitable because of its airmiles program: https://viewfromthewing.com/american-airlines-loses-money-flying-passengers-all-profit-comes-from-selling-miles/

greatdrams23 t1_j10lpv4 wrote

37 million in special items. I think we all know what that means for an international company.

Bobson_P_Dugnutt t1_j10mexu wrote

Obvious_Chapter2082 t1_j10pgun wrote

Like what?

pompatous665 t1_j10uax3 wrote

Why does the “Othet Expenses” - “Interest Expenses” line increase?

TheThingsWeMake t1_j113u2l wrote

Alluvial diagrams, so hot right now.

globglogabgalabyeast t1_j119jqe wrote

That’s the breakdown I really want to see, showing all the profits from loyalty programs and selling points

vicvinegarboiling t1_j11bapu wrote

This should all be pretty much public info for American. Exec pay should be easily googleable as well as average pilot pay and number of pilots, similar info should be available for other work groups. Whether you think they are overpaid is a separate matter but corporate salaries don’t make up a significant enough portion of salaries to warrant breaking it out here.

blbrd30 t1_j11qwy4 wrote

Yeah this post feels super disingenuous, or else OP is just not informed

JamminOnTheOne t1_j11uz8q wrote

Operating expenses include all ongoing expenses, including marketing, etc. The only expenses that aren’t included are capital expenses (eg, buying planes), which aren’t shown directly on an income statement (the depreciation is an operating expense, not the purchase price).

scott_steiner_phd t1_j12676l wrote

> I know for a fact the CEO of my airline made more than the whole department of cabin crew and that's just one guy so yeah forgive me for being skeptical 🤨

American's CEO had a base salary salary of $1.3 million , with potential bonuses up to $2.6 million cash, plus and additional stock grants. He was paid a total of $10.4 million in compensation in 2020, the most recent year I could find, with the large majority of that being stock grants that wouldn't show up on the balance sheet (or this chart.)

Edit more recent source: in 2021 he was paid a total of $766,000 cash and $4.2M equity. His $766,000 would not be visible on this chart.

comeberza t1_j13gm85 wrote

We tend to think about big companies like cash grabbing monsters with ever growing profits and most big companies have margings so tight that a little change in regulation, taxes or market trends can basically turn their numbers red. The biggest supermarket in my country operates with 1 to 2 % revenue and people have the idea that they mark up their products

KTBFFHCFC t1_j1677z8 wrote

KTBFFHCFC t1_j167bc1 wrote

Watch this. It explains how it works perfectly.

Tiabaja t1_j16qkqi wrote

Wow...that's interesting.

giteam OP t1_j0yh7u6 wrote

Source

Newsletter

Tools: Figma Sankey