Submitted by rosetechnology t3_zob3lb in dataisbeautiful

Comments

Jolly-Fox2749 t1_j0m2tre wrote

Would love to see BBK electronics compared to these!

MagicJava t1_j0md3fn wrote

Interesting place to soapbox

ConqueredCorn t1_j0neud6 wrote

Home depot kinda blows my mind. Like its bigger than all american grocery stores? Bigger than nike? Bigger than pretty much any company i can think of that seems bigger

ConqueredCorn t1_j0newju wrote

Usa vs China vs japan vs germany

QuarterSwede t1_j0nijwd wrote

HD is a company of 400K+ and growing rapidly. It’s way bigger than people think. There’s a crap load of money in pro business.

detectiveDollar t1_j0ny909 wrote

Facebook being larger than Disney is kind of wild to me.

PsychologicalDark398 t1_j12zmsd wrote

and vs South Korea too.

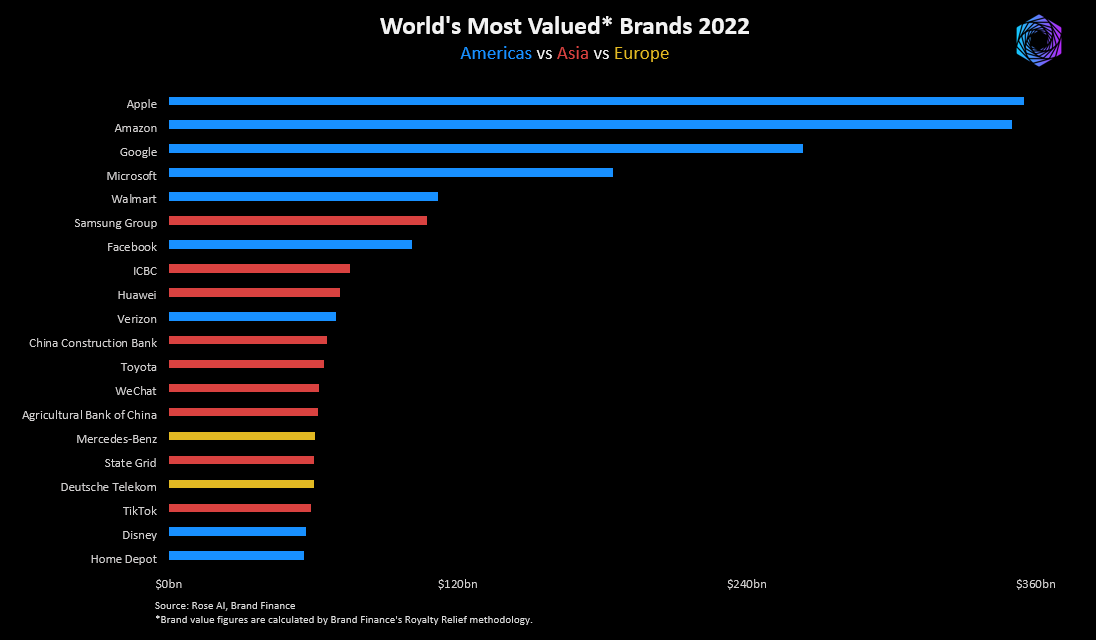

rosetechnology OP t1_j0lu2kz wrote

Sources: Brand Finance

Generated using Rose AI

"Brand Finance's Royalty Relief Methodology is based on the notion that a brand-holding company owns the brand and licenses it to an operating company. The notional price paid by the operating company to the brand company is expressed as a royalty rate. The NPV (net present value) of all forecast royalties represents the value of the brand to the business. This method is based on commercial practice in the real world. It involves esti-mating likely future sales, applying an appropriate royalty rate to them and then discounting estimated future, post-tax royalties, to arrive at a NPV. The steps in the Royalty Relief brand valuation process are as follows:

− obtain brand specific financial and revenue data,

− model the market to identify market demand and the position of individual brands in the context of market competitors,

− establish the notional royalty rate for each brand"