Comments

Jordy_Pordy t1_ixc73j8 wrote

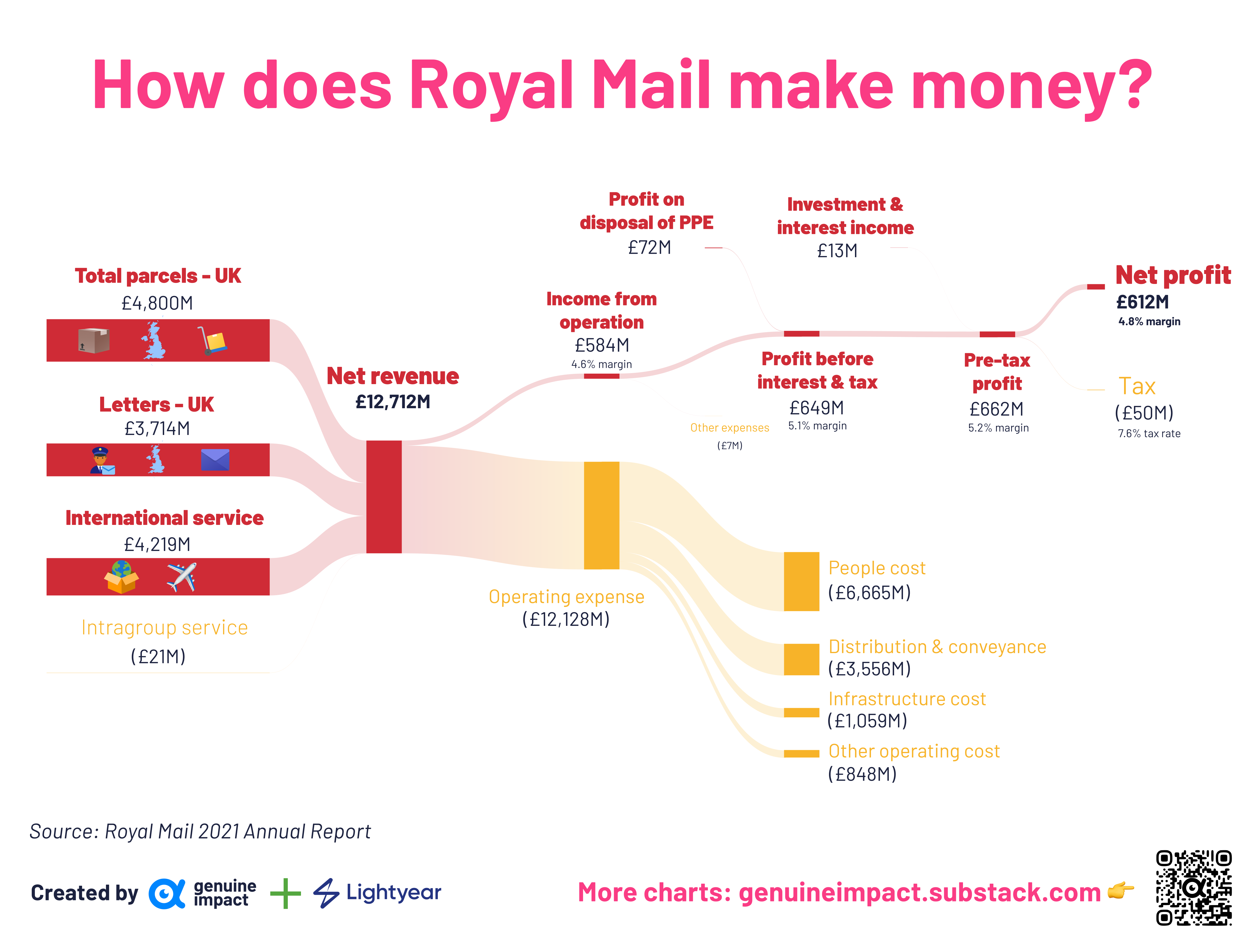

Can someone explain the 7.6% tax rate?

ASK_IF_IM_PENGUIN t1_ixc78jl wrote

The issue for Royal Mail was privatisation.

For nearly half a millennia it was a public service. It was hamstrung by putting requirements on it which weren't necessary for competitors, and when, unsurprisingly, it struggled to compete it was sold off. It's since continued to struggle. It's shares still trade below the "low" price they were issued at.

Now, just like with Hermes, they're trying to rebrand and distance themselves away from the name.

500 years of history almost gone through short termism and mismanagement.

Lav_ t1_ixc7fe5 wrote

Here's why I support the public funding of services like royal mail: imagine £682m into the treasury.

And if they didn't want to make a profit, imagine the savings for end users OR better wages for employees.

But nah, privately owned, the users and tax payers don't see any benefit, it's all for the shareholders.

trickster1979 t1_ixc9i5g wrote

Please explain how Royal Mail are giving shareholders money. The Ceo has a huge salary. Also managers had a £1k lump sum each yet the bread and butter of that company the foot stompers aren’t giving a pay rise that matches inflation

Make_the_music_stop t1_ixc9qwo wrote

Capital allowances probably. UK has one of the longest most complicated tax codes in the world.

Jordy_Pordy t1_ixccnnk wrote

Possibly capital allowances, but that would affect overall tax payable, not necessarily the rate of tax?

Make_the_music_stop t1_ixce1gv wrote

Maybe? I don't know. I assumed the effective tax rate of 19% down to their 7.6% was down to allowances, adjustments and fancy accounting.

Jordy_Pordy t1_ixcenyn wrote

Capital allowances, from what I recall, only applies to the tax burden, and not the tax rate. It could be possible that it is a form of subsidised tax rate specifically for Royal Mail. But from a further look at the statements, page 57 shows the adjustments, with 19% being the effective rate. So possibly an error on OPs part.

edit: nevermind, effective tax rate is 7.6%, down by 11.4%, due to remeasurements of deferred tax, net pension credit interest, and uncertain tax provisions.

_RandyRandleman_ t1_ixcil0d wrote

because they work really hard and definitely deserve it /s

trickster1979 t1_ixcizkl wrote

The shareholders work hard lol. What about the people out delivering it in all weathers and during a pandemic’s

_RandyRandleman_ t1_ixcj29h wrote

i’m talking about the shareholders mate

trickster1979 t1_ixcj7x5 wrote

Yea and I’m talking about the delivery guys do they not work hard enough to get a payrise ?

_RandyRandleman_ t1_ixcjl50 wrote

omg yes obviously you muppet. you said why they’re giving shareholders money and i replied with a joke

tscello t1_ixcmck0 wrote

curious — are capital allowances similar/the same thing as capital tax rebates that corporations receive incentively from their government?

PleaseDontMindMeSir t1_ixcpq1u wrote

> Here's why I support the public funding of services like royal mail: imagine £682m into the treasury. > > And if they didn't want to make a profit, imagine the savings for end users OR better wages for employees. > > But nah, privately owned, the users and tax payers don't see any benefit, it's all for the shareholders.

the treasury got £3.3bn from the sale of the shares and the initial offering of shares were sold to UK residents as a preference, and then UK pension funds for most of the rest, with 10% of the company given to employees for free.

PhallusyOfYouth t1_ixczmzy wrote

Why are all the values slightly off when I compare them with page 76 of the source material, annual report 2021? https://www.annualreports.com/HostedData/AnnualReportArchive/R/LSE_RMG_2021.pdf

Jordy_Pordy t1_ixd3no1 wrote

Quite possibly, from what I have done so far with them, they are just allowances to reduce the tax burden relating to capital assets. But yes, I think they are incentivised via the government to encourage larger corporations.

SnooHesitations6320 t1_ixdcp9v wrote

/s means sarcasm

HeyItsMedz t1_ixdmwg2 wrote

>imagine £682m into the treasury.

Considering the government spent about a trillion last year, it wouldn't even be noticeable (were talking about 0.07% of annual expenditure)

Hot-Delay5608 t1_ixdngx1 wrote

Imagine Muskrat buying the Royal Mail and do the same thing he did with Twitter to it. Not giving two fucks about contractual obligations and such. but at least the Tory maggots would be ecstatic, that is until their letter and deliveries wouldn't come, but of course they would go on blaming the immigrants, the EU and the workers

MagicPeacockSpider t1_ixe8z7n wrote

3.3bn on a company that nets 0.7bn a year was a huge rip off.

Most of the shares initially went to Goldman Sachs and other merchant banks and sold onto pension funds at a profit.

The treasury would have been off better holding on to it, we'd be better off buying back.

rlamacraft t1_ixeb4o6 wrote

So we should nationalise all profitable businesses?

daviEnnis t1_ixegl8x wrote

That's still significant for something with such a broad scope as the government, every reasonable sum looks like nothing when compared against their total. Hand it to a specific department or venture though..

bsnimunf t1_ixelz0c wrote

The royal mail has huge pensions liabilities and huge risks going forward. With electronic communication It's no longer an essential public service. I'm generally against privatisation but the government were right to privatise the royal mail it can't be the company it was 30 years ago.

[deleted] t1_ixep8wk wrote

[deleted]

St0neA t1_ixgobbh wrote

Were you touching yourself writing that?

giteam OP t1_ixc45t9 wrote

The Royal Mail is the national postal service for the UK. After a year in which parcel and letter deliveries were disrupted by the pandemic, is the Royal Mail back to its best? Well, judging by the planned strikes over pay during the Black Friday and Christmas season, perhaps best just isn’t enough.

Source:

Royal Mail

Genuie Impact newsletter

Tools:

Figma Sankey