Comments

thatHadron t1_ivxrjhj wrote

Interested to see how Sydney compares on this

wanmoar t1_ivxwz8d wrote

The government heavily subsidises HDB's but does not pay for them fully

wanmoar t1_ivxx45y wrote

Unless rents in Sydney went up 30-60% in the last year, it doesn't even come close.

Doom-Slayer t1_ivxyyly wrote

New Zealand is pretty bad too. I quickly took one of the HPIs and indexed it to 100 at 1990 and it peaked at ~820 in Dec 2021, shooting up form ~500 in the space of less than two years and now down to 770. So ours is bad, but more recently very bad.

jeronimo002 t1_ivxz6a8 wrote

This is very misleading!

the goverment helps with housing a looot over there.

the % of houses that are on sales are very expensive because they are for the richest % in the state.

https://www.youtube.com/watch?v=3dBaEo4QplQ&ab_channel=PolyMatter

jeronimo002 t1_ivxziu1 wrote

they do. the prices here are the prices of the houses the richest 20% buys

https://www.youtube.com/watch?v=3dBaEo4QplQ&ab_channel=PolyMatter

niknah t1_ivy13vd wrote

If this chart started 10 years ago, it wouldn't look as bad.

Here's a comparison with people's incomes... https://www.numbeo.com/property-investment/gmaps.jsp

ExHax t1_ivy1x3h wrote

Im sure youre not in singapore

no-name-here t1_ivy2alm wrote

why do you say that? What this chart shows is price change relative to an arbitrary starting point. It does not show how affordable is relative to income, which is the important thing.

Edit:

>In the study, housing in Singapore is the most affordable, with a price-to-income ratio of 4.5 for HDB units. As mentioned earlier in the report, more than 80 percent of Singaporeans live in HDB units (figure 8). Although the price-to-income ratio for private homes is high at 13.3, private homes represent less than 20 percent of all housing stock and cater to wealthy Singaporeans and foreigners. ...

> [Singapore's] high homeownership rate of nearly 90 percent and the low cost of government housing units (known as HDB units) directly stem from the government’s consistent commitment and policies to provide affordable and good-quality housing to its citizens.

Source: Urban Land Institute Asia Pacific Home Attainability Index published 2022-08-25 (PDF page 16). "This report analyses housing attainability in 28 cities in five countries: Australia, China, Japan, Singapore, and South Korea."

[deleted] t1_ivy50od wrote

[deleted]

traser- t1_ivy5ecc wrote

Isn’t this showing resale prices? Sydney might be similar on sale price growth.

Inner-Patience t1_ivy6csj wrote

The comparisons are not apples to apples. You have Singapore where you took only the resale segment of public housing, you have hong kong data set which includes both public and private housing, and the restrictions on hk public housing resale are more restricted than that of singapore.

And this is just the two countries I'm more familiar with. I don't have much confidence if you are using the right comparison for US if the two out of two I'm familiar with are wrong

Throwawaytehpengcup t1_ivy9fex wrote

Yea but the price of a Built-to-Order (BTO) is also based on the resale HDB market price.

Context: once you receive keys to your BTO flat, you have to fulfill a minimum accupancy duration (5 years) before you can sell them to the free market as a resale flat, where the price tend to be much higher even after a lot of government subsidies. Resale flats are quite expensive because you get to pick which HDB and location whereas BTO flats requires you to ballot (based on luck) + wait 7 years for it to be build.

Throwawaytehpengcup t1_ivy9wqq wrote

Even with the generous government subsidies HDB flats (both resale and BTO) are rediculously expensive. Also to qualify for the higher tier subsidies requires you to earn a lower monthly salary, so your best bet is to BTO/ buy a resale when you are unemployed or in college with your college sweetheart.

Also now the required downpayment has increased from 10% to a whooping 20% now. Who the hell has 80k sgd in their bank account at their late 20s???

earthlymonarch OP t1_ivyb4ak wrote

I think the resale prices also follow the overall price trajectory in the housing market, because shortages in BTO units are pushing more people into the resale market. The August 2022 BTO exercise closed with 39,136 applications for the 4,993 units. I don't think the high prices - whether through BTO or resale - is going to be a short-term issue (as highlighted in the chart subtitle).

ALJY21 t1_ivyb876 wrote

Even if that’s the case, would you argue that income increases for the other global cities listed here are significantly less than Singapore?

no-name-here t1_ivycuks wrote

But how would that be more important than housing prices as a multiple of income? Whether other countries went up more or less, if housing was a lower multiple of income in Singapore, would relative increases or decreases be more important to you? I've added a source in my parent comment as well.

Per the study above, Singapore housing costs were 4.5 times income, whereas another city had housing that was >40 times income.

If housing started out costing 1% of your income, then increased to 6.5% of your income, that would show as 6.5 in the OP chart. Whereas if another theoretical city had housing costs go from 45% of your income to 60% of your income, that would show up as only a 0.33 increase on the OP chart, or ~1/20 as much of an increase, even though the final cost was ~10x higher in the second location, and even though the absolute change was 3x as much. But you can't tell any of those things when you're only shown relative increases of 6.5x and 0.33x.

jeronimo002 t1_ivydf3c wrote

Housing is ridiculously expensive worldwide.

The sittuation however is much better than hongkong!

Comparing it to the US makes ZERO sense. Singapore was still a develloping country in 1992 while today, the US is becoming a develloping country if they continue on their track.

Singapore has a considerable higher purchasing power than hong kong

You can't point to a single cause, but probably housing has catapulted Singapore above what it could be if it took the hong kong approach.

Singapore has overtaken the GDP per cap by 50% compared to hong kong in the graphs period and the prices don't show that.

again, the whole world has expensive houses (Neoliberalism does that). the US and Europe have the same problems, probably even worse!

Inner-Patience t1_ivydj93 wrote

Downpayment can be paid using cpf. Assuming your monthly CPF contribution is 1k (which isn't a lot considering there's employee and employer portion), that's 12k a year without including in bonus. If based on CPF account allocation (OA, SA, MA), it's 23% of salaries that can be used for housing downpayment.

Working 4 years there's already almost 50k CPF for downpayment for just one person, and usually housing is funded by two persons. I would say that's achievable in the late 20s

[deleted] t1_ivyduja wrote

[deleted]

Eric1491625 t1_ivye2gf wrote

The government doesn't even subsidise a quarter of it for the average person at today's prices.

Bewaretheicespiders t1_ivyjnzg wrote

Another reminder that density never solved high housing cost, and never will.

ALJY21 t1_ivymbq8 wrote

It’s not more important, but as important.

It’s two different sets of data; they tell different stories. OP’s data shows that income did not keep pace with housing, although this could be the same with the other cities. I agree that absolute data could have been useful.

Your cited data does imply affordability in Singapore, but I might question it’s methodology. Is it really affordability if household income is being held up by the rapid rise of dual income households in Singapore? Is the trend of dual income households the same for these other countries? They might seem more expensive because dual income % may have not seen similar growth. This is why despite how “affordable” Singapore seem to be, it is a huge struggle to have a family. Nobody in the household can afford to stop working.

What’s going to happen to single person breadwinners for example, if the government uses dual household income as a gauge for affordability (as they are now)? What used to be affordable for single income households now requires dual incomes to sustain.

Therefore, a more robust way would be to calculate single income over price/sqm ratios instead of household income vs house (which can vary in size)

ottawalanguages t1_ivyn6b3 wrote

What software did you use to make this? Great job!

LouSanous t1_ivys1fk wrote

A 7000 sqft piece of land far away from a city in NZ goes for like $100-$180k NZD online.

No wonder kids there kill themselves at rates double that of the US. There's no future and a lot of them know it.

ghartman41 t1_ivyw010 wrote

This also doesn't show how unaffordable the cities were to begin with. They all start at the same number when NYC could have started out significantly higher and not increased as much in this time period.

nacho1599 t1_ivywsul wrote

What will then?

Aqueilas t1_ivywwa8 wrote

This is also not accounting for the fact that comparatively, the other cities may be starting from a more expensive point in 1990

Bewaretheicespiders t1_ivz13ke wrote

There are only two things that ever worked, and only one of them is sustainable. First, sprawling, until you run out of space. Nothing as cheap to build as a bungalow, and low density keeps land value low.

The other and only sustainable way is zero population growth.

nacho1599 t1_ivz1exl wrote

Why would sprawling outward help but upward wouldn’t? The GTA sprawls out like none other, yet it has one of the highest housing costs in the world.

alvinofdiaspar t1_ivz2tg2 wrote

The problem with the Greater Toronto Area is that there is tons of technically redevelopable land that aren't intensified because public policy shields single family homes from development pressure - this limits new housing to either the urban boundary, formerly industrial brownfields OR high-rise condos at very selected locations - which coupled with the rapidly increasing population is the cause of the problem.

There are some commonalities with Singapore though - in that housing is considered an asset for future retirement needs, which makes policy gearing towards popping the asset bubble unpopular to the subset of demographic/voters currently in power. But unlike Singapore where government public rental housing is a thing, it really isn't here in the GTA (or North America in general) for all except the lowest-income population. Relegating housing entirely to pretty much the private sector alone is a giant public policy failure.

Bewaretheicespiders t1_ivz7sej wrote

As Ive explained, sprawling helps because it keeps both construction cost and land value low, while density makes construction cost and land value high.

Toronto doesnt sprawl nearly enough for Canada's insane population growth. They locked it inside the green belt. Which I understand why they would do that, but you can't do that AND add millions of new people, not without housing being a nightmare.

GamingRanger t1_ivzbs6t wrote

But but but but but PolyMatter told me they solved housing

GamingRanger t1_ivzbuvs wrote

Jesus Christ how can you be so dense.

NewSinner_2021 t1_ivzhkp1 wrote

Housing is used as a tool to money launder and society is paying for it.

badchad65 t1_ivzi1uu wrote

Eat shit. Yes, the cost is rising. Millions of people still live there. Ergo, they afford it, unless you’re dense enough to imply they live there free.

nacho1599 t1_ivzi2yg wrote

Wouldn’t density keep land value low because there is more free land relatively? Can you elaborate on that?

stiffgordons t1_ivzkllx wrote

Are we pretending that HDBs aren’t a thing?

For the uninitiated, Singapore has a Housing Development Board which builds houses and sells them to Singaporean nationals who meet certain criteria. After a wait list and a bit of luck subsidised apartments are available.

These are considerably cheaper than condo apartments, so this whole post reads like a whinge.

Bewaretheicespiders t1_ivzqj9l wrote

Land value is directly correlated to the profit you can make of developing it. The higher the density, the higher the value. When cities change the zoning to allow more density, land value increase correspondingly because the vote is even tallied.

Captain_dragonfruit t1_ivzrg3s wrote

Right, they can type out New york city, but not san fransisco

Newmanuel t1_ivzt7x7 wrote

average salaries is a very distorting metric, particularly in high cost cities that house many of the ultra rich. I live in NYC and 6.1k/mo after tax is not an average salary here (thats like 120k annual pre tax). If you look at the median income in most neighborhoods, youll find that outside of a few strips of manhattan and the prospect park area, its somewhere between 35-70k.

carrotwax t1_ivztj37 wrote

I wish there was real awareness of the underlying factors. In our financialized economy (compared with an industrial one), bankers require a minimum interest rate that is higher than the economic growth. We've also made it near impossible for countries or normal individuals (but not corporations or the rich) to declare bankrupcy. To get out of problems like 2008 and the covid economy, more money supply was introduced through "quantitative easing". Where can the money go? Big money doesn't invest in business as much any more - real estate is desired. Then competition drives prices up. Banks like this because most of the housing inflation money goes back to them.

The economy is like a ponzi scheme in the long run. Everyday people pay for it.

No society in history lasted a long time without erasing debt on a massive scale. A good read is David Graeber's book on the history of debt: https://www.goodreads.com/book/show/6617037-debt

Deto t1_ivzv1fy wrote

Yeah, this would look totally different if you started it at 2000 instead.

Maguncia t1_ivzxdhe wrote

People care about housing cost, not land value. A limited upzoning on a few plots will make those plots of land more valuable because there is a scarcity of developable land. Individual housing units will still become cheaper, though, since supply will increase (obviously a developer will not be able to sell the new units on upzoned land above the market, and they will provide competition to existing single-family homes). A large-scale upzoning will remove that scarcity, and land prices won't change nearly as much, except in truly prime locations that were very underzoned for some reason. Marginal land on the periphery (outer suburbs, exurbs) will lose a lot of value, since people are no longer squeezed all the way out there. Individual units will become significantly cheaper everywhere, of course.

Maguncia t1_ivzyn65 wrote

I mean, every time the price the buy real estate rises, fewer people can afford it - that's just a truism. Not sure what logical step is eluding you. Fewer people can move there, more people have to emigrate, more people have to rent instead of buy, more people have to live with their parents.

CultCrossPollination t1_ivzz0dd wrote

whats the median wage in NZ?

I am from the Netherlands and such a price would be dirt cheap, it's about halve of what we pay per sq meter at the cheapest areas.

Honestly, I think suicide is too serious to deduct it too such a single variable.

LouSanous t1_ivzzcf6 wrote

Poverty is widespread in NZ.

There was a time when I thought it would be the best country to move to, but the more I dig into it, the more I realized it's kind of a shitty country. It's beautiful, but you'll notice it always scores highly on "economic freedom" which is code for letting corporations run roughshod.

GamingRanger t1_iw02dto wrote

Millions of people can live in Los Angeles, they can’t afford it. Tens of millions live in Lagos and Jakarta and Kinshasa but they CANT afford it. Affordability is not about how many people live in an area. Infact more people in a smaller area = less affordable unless you increase your housing supply. Which is why people leave places like LA to go to “boring” places like Phoenix. You can’t just leave Singapore though. Or Hong Kong or Macau or any of these other micro states with the highest housing affordability issues of any nations on earth.

Bewaretheicespiders t1_iw08878 wrote

Land value diffectly affects housing cost. Its why you see dilapidated buildings selling for millions of dollars in Vancouver.

If you think density can solve housing cost, point us to a city that became cheaper by densifying.

badchad65 t1_iw08cxt wrote

If I don't pay my mortgage, my home gets foreclosed. If you don't pay the rent, you get evicted. By definition, how are people living a place they cannot afford?

Is the cost of living so high it probably sucks ass to live there? Certainly. You can find plenty of people living in closets in NYC for ridiculous prices. Looks like a shitty living situation to me, but they appear to afford it.

badchad65 t1_iw09ke0 wrote

If I don't pay my mortgage, my home gets foreclosed. If a tenant doesn't pay rent, they're evicted. How can someone "not afford" their living expenses, yet simultaneously live there? As is the case with millions of people in Singapore?

Your point about real estate is spot on. As prices rise, fewer can afford it, so they leave. So according to this logic, if 5 million+ people live in an area...

Singapore's population is just now starting to decrease, so yes, so some people, it appears its becoming unaffordable.

bitcornwhalesupercuk t1_iw0boia wrote

Toronto is way worse . We are the biggest bubble in the real estate world

Scurouno t1_iw0ebbg wrote

I can say without a doubt that there is high wealth disparity in NZ (I have lived there at several points in my life). Public sector pays poorly relative to cost of living, and many private sector jobs pay below their equivalent overseas. It is absolutely necessary to be a dual income family, and many women are forced to have new partners they barely know move in with them, just to pay the bills. It puts women and children in extremely vulnerable positions. Also due to its small population and tight supply chain, wholesalers rake in massive profit margins. Once you include retail profit margins, you see prices up to 200% above other countries. Energy is also incredibly expensive, and you have to get used to being cold in the winter, or paying through the nose for electricity, as most houses have very poor (if any) insulation and winter temps do dip below 0C. One thing I noticed as a Canadian expat living there is how 'user pay' a society it is. There are very few truly 'free' events there, and most public fairs or gathers or festivals will have entry fees on top of paying for all activities. Its a beautiful place which can afford a variety of lifestyles and varied landscape, but it definitely comes at a high cost.

GamingRanger t1_iw0fwtz wrote

I refuse to accept someone can be this dense

badchad65 t1_iw0gn5d wrote

Excellent rebuttal. Come back to me when you have the cognitive capacity to formulate an argument.

We can argue semantics indefinitely. When something is “unaffordable,” the price is too high for you to purchase. Millions are paying for housing in Singapore. It probably sucks, but if they couldn’t “afford” it, they’d be kicked out and unable to live there.

ImperialAce1985 t1_iw0grst wrote

Western nations spending money on Ukraine, the post-pandemic world, the WEF, and the Biden inflation. At one point housing and food will become unaffordable and unsustainable to the point that people will lose their freedoms, their savings, even their health and livelihoods.

nacho1599 t1_iw0swzm wrote

I don’t see how that’s the case. Obviously a tower than can house 500 people would be more valuable than a duplex, but that tower then takes 500 people’s worth of demand away from the rest of the real estate system, decreasing prices.

T3rribl3Gam3D3v t1_iw0uct0 wrote

I'd expect housing to go to 320% from 1992 so those other cities aren't really that high

SG_wormsblink t1_iw0vzoq wrote

We did. OP is misrepresenting the situation by using private market prices to compare, when obviously the majority of housing in Singapore is public housing.

Bewaretheicespiders t1_iw13m11 wrote

Im not talking about the value of the tower, thats a whole other thing, but the value of the land underneath it. If you change the zoning from single family house to, say, 10 units on the same area of land, and if there is enough demand, then land value immediately climbs by 10x, because a developper now can make 10 times as much profit on that parcel of land. And that takes away any of the affordability gain you would expect from density.

nacho1599 t1_iw14t65 wrote

Sure, but it cost the developer $50 million to build that tower, which improves the land's value legitimately. I'm saying the tower lowers the price pressures in the rest of the area because it increases the supply.

VALMaX1 t1_iw1bgwm wrote

I live in India and I dont think prices have gone much higher here....

Because most people rent here.

Bewaretheicespiders t1_iw1cuzd wrote

The land value improves way before the tower is built. Sure you build supply, which is better than doing nothing, but that new supply takes way more manpower per sqft to build, AND increase land value, compared to sprawling.

[deleted] t1_iw1imvq wrote

[removed]

nacho1599 t1_iw1kwnj wrote

But the land value all around decreases

Professional-Ad-2031 t1_iw1q3ip wrote

interesting comment, would like to come back to it

fearatomato t1_iw1qfsf wrote

that's not relevant at all. youth are looking to live in apartments in and close to cities not 7000sqft in the middle of nowhere.

the_snook t1_iw23x6o wrote

Yeah, everyone calls it Frisco.

*ducks*

sfasdf2141 t1_iw277cf wrote

It's expensive but it doesn't really compare to the worlds most expensive property markets. Auckland is 12x median income to purchase a property. Over 100 cities are worse including Beijing at 55x, Hong Kong 43x, Taipei 35x, Seoul 31x, Paris 20x, etc.

sfasdf2141 t1_iw279w9 wrote

In terms of affordability Sydney doesn't really even compare to the most expensive housing markets.It's expensive but over 150 cities are worse (some far worse) when looking at years to purchase a home.

sfasdf2141 t1_iw27d0i wrote

Toronto doesn't even remotely compare to the most expensive housing markets in terms of affordability. 140 cities are less affordable in terms of years of salary to earn an income than Toronto.

>We are the biggest bubble in the real estate world

Not even close. Maybe get out of your bubble.

pritybraun t1_iw2b07r wrote

Makes for informed reading but do excuse my ignorance what does HPI stand for. Ta!✌🏾

Doom-Slayer t1_iw2bypl wrote

House Price Index. NZ doesn't have an official one, but two made by private companies are produced.

[deleted] t1_iw2cygy wrote

[removed]

Bewaretheicespiders t1_iw3fp9l wrote

It in fact increases.

MistaKid t1_iw45wmn wrote

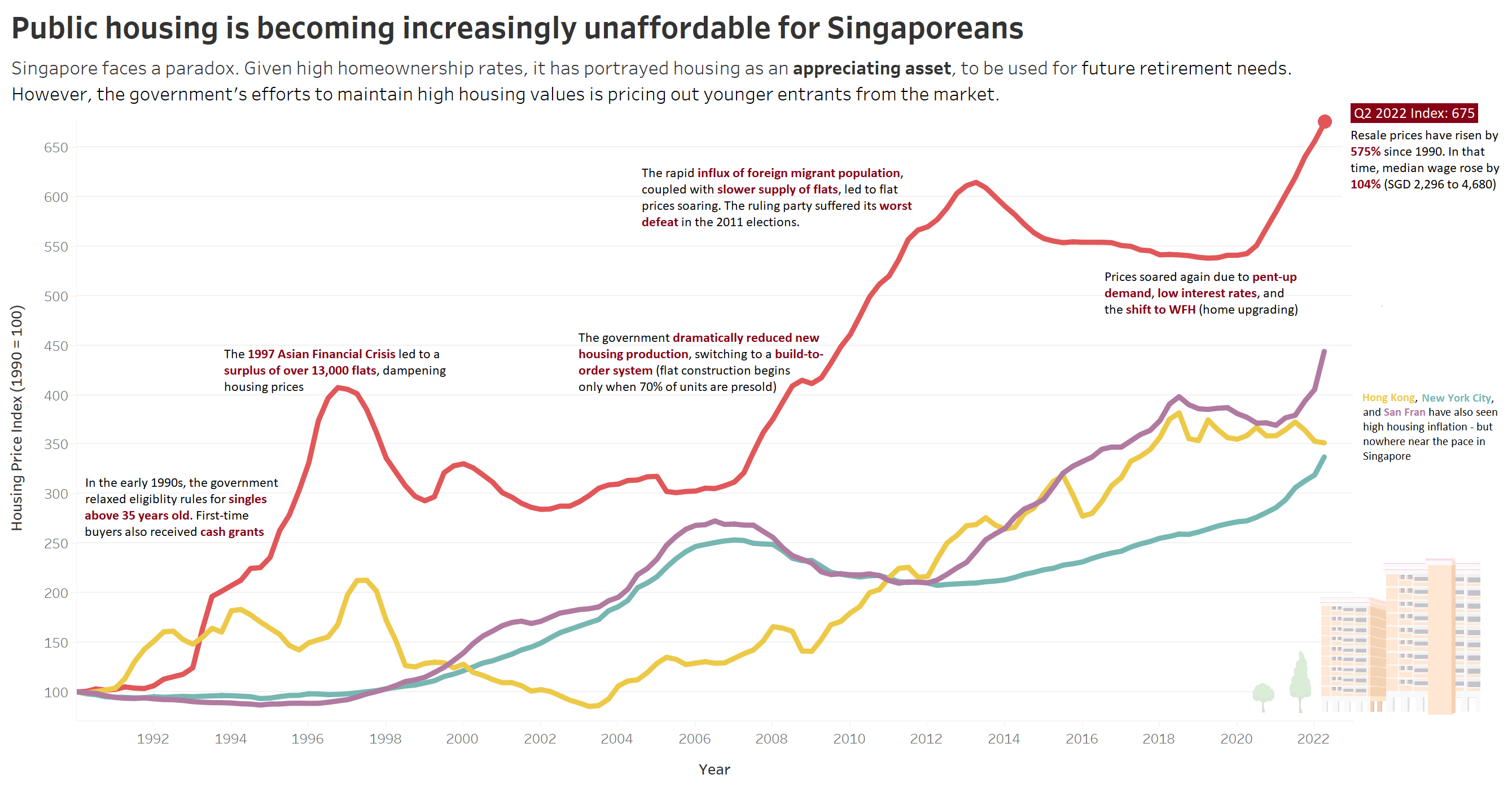

Figures for income growth are wrong. Apples and oranges.

SGD2,296 refers to median household income in 1990. A fair comparison would be to compare it with the latest median household income, not median wage. The median household income is SGD9,520 in 2021, representing a ~315% nominal increase instead of 104% as indicated in the graph.

https://www.nas.gov.sg/archivesonline/data/pdfdoc/2001020903.htm

https://tablebuilder.singstat.gov.sg/table/TS/M810361

The median wage is SGD1,094 in 1990, and SGD4,680 in 2021. A nominal increase of around 328%.

(pg186 bottom for 1990 figures)

bitcornwhalesupercuk t1_iw498tk wrote

Sorry your wrong . https://www.ubs.com/global/en/wealth-management/insights/2022/global-real-estate-bubble-index.html I also don’t think you know I’m referring to a bubble not income to housing costs. Please read what I sent you.

carrotwax t1_iw4tm7c wrote

Michael Hudson is a great source if you have time to listen to some of his youtube lectures.

sfasdf2141 t1_iw6l1cp wrote

UBS report is useless. Go look at the edition from 5 years ago and you'll see they are completely out of touch, with no predictive power.

Your own source shows that Toronto is cheaper than average for the # of years to own an apartment, while also having reasonable rent costs. Looks as though you didn't even read your own source? Or did you just eat their spoon-fed conclusion rather than do any critical thinking, because it's what you wanted to believe? Seems like it.

It's only Canadians who have never stepped outside their country that think Canadian real estate is some crazy anomaly. it's not.

[deleted] t1_iw8t3ju wrote

burgiebeer t1_iwaina1 wrote

If we’re not going to call it HoKo or New Yawk, could we please call it “San Francisco”?

burgiebeer t1_iwaiox0 wrote

I came here just to say that.

earthlymonarch OP t1_ivxrjgg wrote

Sources:

All indexes have the base year set in 1990

Tools: Tableau