Comments

panini3fromages t1_ivo373c wrote

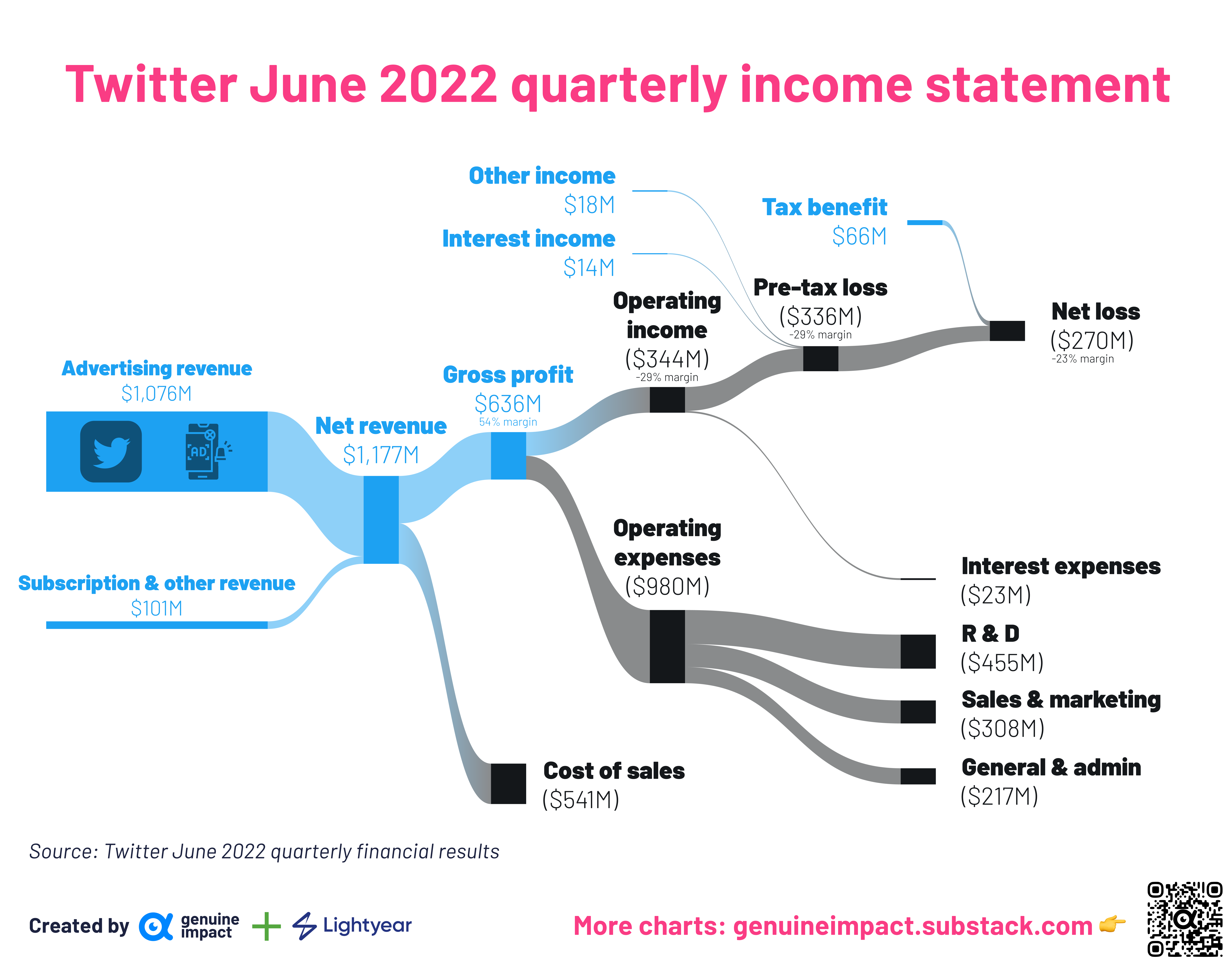

I love Sankey charts in general and this is a very relevant one. Thanks for making and sharing it!

Friedrich_Cainer t1_ivo3s1t wrote

What is their ‘Cost of sales’?

MaximumEngineering8 t1_ivo44i6 wrote

I have an MBA, and I'm embarrassed to say this one always confuses me with services companies. It usually refers to raw materials, but with an IT company, I still don't know.

Lightweight_Hooligan t1_ivo4m2i wrote

Tax Benefit - does this mean they pay tax or receive a rebate?

BelAirGhetto t1_ivo55dy wrote

So, we’re giving the richest man in the world $66,000,000?

On top of the 5 billion we already have him?

And he calls democrats socialist?

jtsg_ t1_ivoac7e wrote

Does it mean server hosting costs?

MaximumEngineering8 t1_ivodbrx wrote

Okay, I looked up the SEC 10-K filing, and below is how Twitter defined it. (I still think it's difficult to delineate between Cost Of Sales and Operating Expenses, but I guess they try.)

> Cost of Revenue: Cost of revenue includes infrastructure costs, other direct costs including revenue share expenses, amortization of acquired intangible assets and amortization of capitalized labor costs for internally developed software, allocated facilities costs, as well as traffic acquisition costs, or TAC. Infrastructure costs consist primarily of data center costs related to our co-located facilities, which include lease and hosting costs, related support and maintenance costs and energy and bandwidth costs, public cloud hosting costs, as well as depreciation of servers and networking equipment; and personnel-related costs, including salaries, benefits and stock-based compensation, for our operations teams. TAC consists of costs we incur with third parties in connection with the sale to advertisers of our advertising products that we place on third-party publishers’ websites, and applications or other offerings collectively resulting from acquisitions. Certain elements of our cost of revenue are fixed and cannot be reduced in the near term.

TownAfterTown t1_ivoggq6 wrote

Yeah, I don't find this intuitive at all. 636M in gross profit splits into operating income and operating expenses where one is -ve and one +ve but they look the same??

Darth-Kelso t1_ivom5na wrote

Idiot question here - how is Gross Profit determined before operating expenses? Shouldn't that and all the other expenses be pulled out before we determine what the profit is?

[deleted] t1_ivp29i3 wrote

[deleted] t1_ivpafed wrote

[removed]

[deleted] t1_ivpqkde wrote

torchma t1_ivq0rfw wrote

There isn't just one type of profit. You're thinking of net profit. This is gross profit.

[deleted] t1_ivrcx4r wrote

[deleted]

pgaasilva t1_iydukbh wrote

The problem with these charts is they suddenly go from 400 mil positive revenue to net negative without showing where the difference is coming from. Negative net losses are being fed from either the cash stash, asset sales or new debt, all of which should be branches in the chart but aren't.

giteam OP t1_ivo28de wrote

Source:

Twitter

Genuine Impact newsletter

Tools:

Figma Sankey