Submitted by USAFacts_Official t3_yl8yag in dataisbeautiful

Comments

USAFacts_Official OP t1_iux5h1v wrote

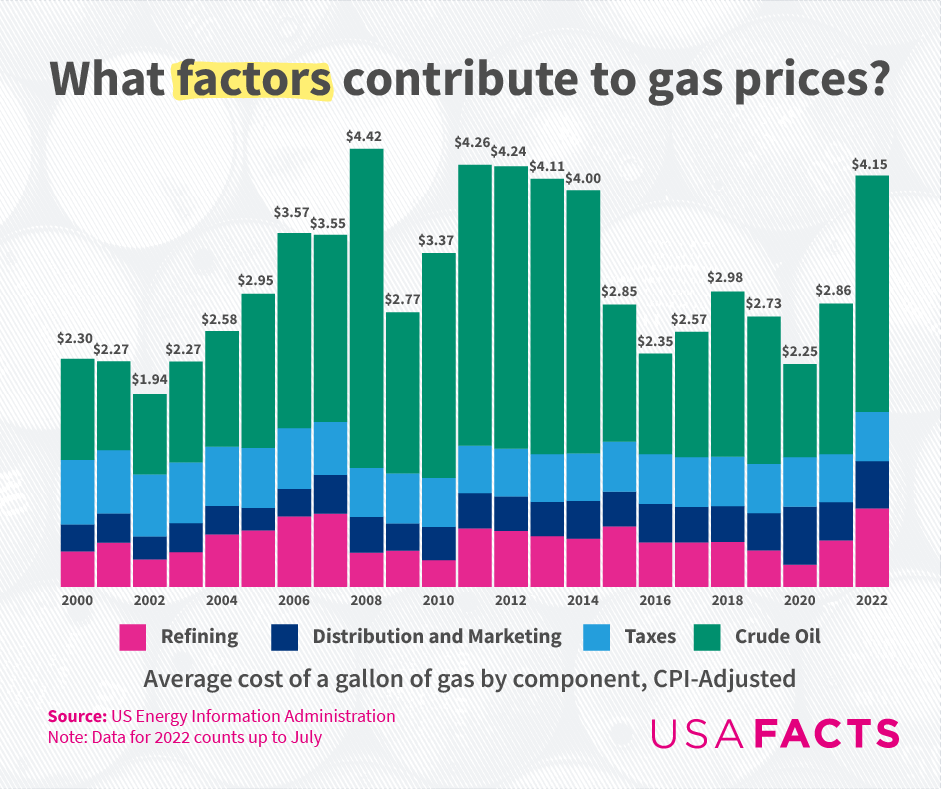

Crude oil prices are just one factor influencing the price of gasoline. While the release from the Strategic Petroleum Reserve primarily affects the price of crude oil, other factors such as taxes, marketing, transportation, and more also contribute to the price of a gallon of gas. Crude oil historically accounts for 40% to 70% of the cost of gasoline.

amanamongbotss t1_iux5k6e wrote

It would be interesting to see the profit margins of each of these components, too.

secret_trout t1_iux5zq4 wrote

I thought the US president was the single determining factor??

madoo256 t1_iux6hyb wrote

Unless it is a president you like, then he has nothing to do with it. /s

AdvancedHat7630 t1_iux7z2a wrote

The level of adjustment for CPI is of interest, too. This isn't a very complete picture.

685327592 t1_iux8urm wrote

The profit is mostly in producing crude oil.

charmquark8 t1_iux9dv8 wrote

Nice visual. So of course, as we all know...

Joe didn't do that.

wtfbro_ t1_iux9f34 wrote

My dad said there is a button on the presidential desk that sets nation wide gas prices.

FrostedAngelinTheSky t1_iuxb7p7 wrote

Wheres the section for profits?

RyGuyyy15 t1_iuxc0rw wrote

If it’s a President I like, he/she is solely responsible for low prices but has no responsibility over bad prices. The opposite is true for presidents I don’t like. It’s a simple calculus, little one. /s

PM_ME_A_PLANE_TICKET t1_iuxdesn wrote

Where's the section that shows how it doubled because of who got elected?

paradigm619 t1_iuxepc1 wrote

Republicans, please take note: Joe Biden is not on the chart.

[deleted] t1_iuxeux2 wrote

[removed]

DM_me_ur_tacos t1_iuxf9od wrote

Exactly... How much of this trend is the CPI variability?

Complete_Fill1413 t1_iuxg05g wrote

"Neither Joe nor Donald had a significant impact on gas prices" Now time to eat popcorn

LakeSun t1_iuxgyo0 wrote

...also, spot market pricing.

Where one Wall Street trade of one barrel, raises the price across the board for all.

It's like there are no long-term contracts. LOL.

Naginiorpython t1_iuxiqq8 wrote

In "I did that" stickers we trust

shindleria t1_iuxirqp wrote

An old lady was crossing the road and fell down beside a gas station in Oakland. Gas prices up!!!

wijenshjehebehfjj t1_iuxk3s5 wrote

Tell that to Valero, PSX, etc.

685327592 t1_iuxknyb wrote

Valero made 2.8B in profit last quarter.. Saudi Aramco made 173B

Wizard01475 t1_iuxlwl4 wrote

Perhaps this is a stupid question, but what would make refining costs double almost triple in a matter of two years? My only thought is cost of labor.

_Lusus t1_iuxtsx4 wrote

Regulation is a factor in some places, such as California. California requirements that gas sold here be a more environmentally friendly blend raise our prices substantially.

Distribution costs also changes substantially based on where you are in the US. I assume these are averages.

But, this chart is not made to be state specific so neither of my points could be handled the ways it's currently displayed.

marzenmangler t1_iuxu66n wrote

That might actually be where the profits are.

From what I’ve read refining shut down in the pandemic and it’s difficult to restart once it’s down, same as drilling. So there was a bottleneck there.

And I think a lot of oil companies also have integration in the refining process, so when there is a bottle neck they can charge a higher price there.

marsh55116 t1_iuxuaf5 wrote

Yet you guys give him credit when it goes down .05!

Ok_Frosting4780 t1_iuxupy2 wrote

Many refineries closed down as demand nosedived during the pandemic. Now demand is back, but the refineries remain shuttered. This leads to a refinery shortage, allowing refiners to hike up their prices and expand their profit margins. So the cost to refine isn't much more, they're just now in a position to charge a lot more for it.

KingTut333 t1_iuxvtf0 wrote

Is it any different for diesel fuel, because I am still trying to understand how we went from diesel fuel being cheaper than 87 octane 8 years ago to where it is now over 50% more than 87 octane?

Warbringer24 t1_iuxvzf5 wrote

I think he identifies as white

Competitive_Artist_8 t1_iuy12hw wrote

Why are crude oil prices so volatile, and why was refining so cheap in 2020?

Bot_Marvin t1_iuy1ayq wrote

…. That’s what a cost is. A court side basketball ticket doesn’t cost more because the chair is super expensive, but because there are fewer of them, a higher price can be charged. Nearly every firm charges the most they are in a position to charge.

wijenshjehebehfjj t1_iuy2j6e wrote

Well yes, a petrostate will tend to make more money than a single refiner.

Ed_Chambers_PP t1_iuy3qrc wrote

"You guys". I think we all know what type of person you are.

QTheStrongestAvenger t1_iuy3tb8 wrote

People using gas prices as an economic health indicator aren't right.

[deleted] t1_iuy4uc7 wrote

[deleted]

nankainamizuhana t1_iuy51yb wrote

Can we get this in a 100% area chart?

garlicroastedpotato t1_iuy5dor wrote

I know refining is incredibly small. They earn $0.05 per gallon of gas sold.

redwings27 t1_iuy77bj wrote

I was going to say, where’s the president’s gas price lever??

ArchdevilTeemo t1_iuy8xgk wrote

For the eu chart, you gotta only need to switch green and blue.

685327592 t1_iuy9yiy wrote

It's not just that they made more, Saudi Aramco's profit margins are absurd whereas Valeros are pedestrian.

Pokerhobo t1_iuya490 wrote

People need to understand that crude oil is traded at global prices, not how much it costs locally. The US has exported more oil than imported, but that oils is still at global prices. This is why OPEC has such an impact on gas prices even if the US is oil independent. The real change is moving off oil completely.

Wizard01475 t1_iuybg8a wrote

Great analogy. Really what this means is the refineries know they have the upper hand and are able to gouge any price they want. What I’m hearing is there is not enough competition.

Bot_Marvin t1_iuybxd5 wrote

And I agree with you right there. More competition is very necessary.

DeadFyre t1_iuycic3 wrote

Gas stations make a profit of between 3 and 7 cents per gallon. This chart illustrates Oil and Natural Gas profits against the S&P 500 for the past five years. What people don't seem to realize that the oil industry age shit through 2020. Now they're earning those losses back, is all.

Ok_Frosting4780 t1_iuycrk1 wrote

I agree. Firms charge whatever they think their clients are willing to pay. The person I was replying to implied that the price of refined oil increased because it became more costly to refine when in reality it's mostly caused by a predictable market reaction to contracting supply and expanding demand.

chrysrobyn t1_iuyczpv wrote

So cool!

Now do one showing how fast prices go up with rising crude prices and how slow they go down again when crude falls!

yogacowgirlspdx t1_iuyemq3 wrote

noting that taxes stay constant. or have gone down. i think this kind of graphing is deceptive.

Bot_Marvin t1_iuyepkb wrote

That’s very reasonable, I guess I just had a knee jerk reaction to similar wording used by people who believe rising gas prices are the result of “greed” as if firms suddenly became greedy haha.

DividedContinuity t1_iuygl38 wrote

I think thats fairly obvious to anyone that isnt blinded by political bias. Global markets aren't controlled by any one country (though cartels like OPEC have a large impact).

DividedContinuity t1_iuyh7v7 wrote

My blind assumption would be the uptake of diesel cars? That was definitely a trend in europe.

mechanical_penguin86 t1_iuyi889 wrote

Where’s the Biden or Obama extra cost?

Oh wait..

There is none.

ThisIsOurGoodTimes t1_iuyiaq1 wrote

PSX refining capacity is about 2mmbl/day or about 84 million gallons. Q3 earnings were $3.1 billion. So a very rough total margin per gallon on all products is about $0.40/gal. It’s much lower on that for fuel though

KingTut333 t1_iuyjn6y wrote

If anything I think the US has had considerably less interest in any passenger diesel vehicles following the VW and EcoDiesel lawsuits over emissions. I'm not even sure what diesel cars you can buy any longer.

LooseEarDrums t1_iuykrgm wrote

Wait. What percentage is due to marketing? It seems crazy that we would pay more for gas because of advertising.

Yacobeam t1_iuypsda wrote

Public policy absolutely plays a factor in the price of crude oil

CazadorHolaRodilla t1_iuyq18o wrote

Keep in mind these are average numbers. For example, taxes vary from state to state and even from county to county

sunsetshanty t1_iuz0797 wrote

I have no doubt this will get down voted into oblivion. I absolutely love how every redditor knows exactly how this stuff works. It scares me how little everyone understands about energy... know where your basic necessities come from people. That includes food and energy. Go find out please.

[deleted] t1_iuz0dqo wrote

Thanks to Biden for making the usa not a net exporter

[deleted] t1_iuz0j1t wrote

Biggest factor

Bobster031 t1_iuz0to4 wrote

"bUt BiDeN iS ReSpOnSiBlE fOr tHe PrIcE oF GaS" - the amount of times I've heard this...

[deleted] t1_iuz1m7n wrote

[removed]

tico_pico t1_iuz393v wrote

This is part of it.

https://www.imo.org/en/MediaCentre/HotTopics/Pages/Sulphur-2020.aspx

Governments started requiring less sulfur in shipping bunker fuel. This meant that previous refinery volumes that got blended into the diesel stream started getting blended into the ship bunker fuel instead.

tico_pico t1_iuz3at7 wrote

Not true

Petey_Pablo_ t1_iuz3bpd wrote

Well O&G companies aren’t building new refineries since this administration has promised to put an end to the fossil fuel industry, so he’s certainly not helping.

dgxpr t1_iuz3s5r wrote

another instructive graph could explain the variable factors of the price of crude & the cost of refining.

dibsODDJOB t1_iuz48kg wrote

Or the Minnesota governor, according to the GOP

Dark_Marmot t1_iuz69td wrote

Please state your case..

Flowersforpepesilvia t1_iuz6f4p wrote

Who regulates crude oil prices?

TiredTim23 t1_iuz8l21 wrote

You see how crude oil prices are the biggest factor? Well, executive branch can make decisions that affect that price.

Edit: Grammar

insultant_ t1_iuzceiw wrote

Because Trump would have made it $1/gallon had he won in 2020, but nooooooooo…

/s

OnePunchedMan t1_iuzcufp wrote

Can you elaborate on how crude oil cost fluctuates? From your chart, it looks like tax, marketing, etc costs are fairly consistent, but I don't understand how/why crude costs fluctuate.

fail-deadly- t1_iuzduk3 wrote

What kind of ludicrous conspiracy theory is that?

It is obviously a dial so they can move prices up and down at will, and not a button.

BlueFadedGiant t1_iuzfphk wrote

Everyone know this is just fake news. The real major contributing factor to gas prices is the President of the United States. President Biden had dial installed in the Oval Office and uses it to turn up the price of gas. Smart people are saying it.

But Biden doesn’t contribute if gas prices go down. Only if they go up. Because reasons.

Novel-Place t1_iuzjowu wrote

Uhhhhh your missing a pretty big one — what companies set for their price point and profit margin. Family friend hasn’t reduced gas prices at all, even though prices have gone back to pre-Russian invasion. He’s making 3x the profit he was before.

prpslydistracted t1_iuzjrls wrote

The graph missed demand against oil companies restricting new wells, plus severely restricting output, which results in higher prices at the pump ... thus, record profits.

Truthirdare t1_iuzk46p wrote

I am surprised refining margins have such wild swings.

656666_ t1_iuzk5pa wrote

Stfu with your political bs. No one is interested in that opinion.

bigwreck94 t1_iuzkjeh wrote

Any factor other than decisions made by politicians you like.

sandee_eggo t1_iuzksu4 wrote

And what portion of inflation is gas prices?

And why are gas prices so low in the US compared to other countries?

InfiniteState t1_iuzloc2 wrote

That’s misleading because Saudi Aramco is cashing in on years of investing in extraction tech and infrastructure. That investment is why we’ve had cheap oil for the last 15 years.

They changed their thinking a few years ago and have decided, given the accelerated pace of the energy transition, to invest a lot less and take near term profits.

jusdontgivafuk t1_iuzm42y wrote

Gee, I wonder why refining is so high right now? Did somebody tell someone else to stop making oil while they were president? Demand low, stop making it, demand high, up production. Wages higher? Weird! It’s beyond me how so many things effect one thing!

Looking at the graph, I wonder which presidents are getting paid off by big oil. 🤷♂️

Torchic336 t1_iuzp2nd wrote

Yeah, which one of these colors is Joe Biden?

Torchic336 t1_iuzp77l wrote

I have it on good authority it is a complicated system of pullies and cranks

PPLArePoison t1_iuzpe0p wrote

You're missing a big factor here:

[deleted] t1_iuzppad wrote

[removed]

amanamongbotss t1_iuzsrei wrote

I agree this should be adjusted for inflation, but the other thing is a different graph totally

gypsysniper9 t1_iuzuy2h wrote

Where is the profit margin ?

katycake t1_iuzve75 wrote

Marketing? Who's advertising gas companies? I don't care who has what gas. It all comes from the same barrel pretty much, and they are the same price anyways. lastly, people will most likely only go to the nearest station there is, when empty. The biggest factor in deciding a gas station is whether or not the convenience store running it has that bag of chips you like.

wtfbro_ t1_iuzzkcf wrote

Like a rubix cube with more steps

TinKicker t1_iv01sdh wrote

I’d say the profit margin for taxes is pretty much 100%.

TinKicker t1_iv02cd8 wrote

No new refineries have been built in the US since the 1970s.

Since it takes roughly ten years and $10B to complete a refinery, no company could justify such an expense on a long term project that could be shut down by the next administration, before construction is ever completed.

Meanwhile, every time a refinery shuts down or suffers a catastrophic accident, that’s one less refinery to produce the nation’s ever-increasing energy.

Bokaza1993 t1_iv02yxy wrote

Probably covers all of the sponsorships you see companies doing, which is often just another form of lobbying. Ohh, and lobbying.

Killieboy16 t1_iv032vh wrote

Wrong! It's all Biden!

/s

paulpaulbee t1_iv0900r wrote

Where is the color for Joe Biden?

phdpeabody t1_iv0dfr8 wrote

Gas doesn’t get more expensive because of inflation. Gas getting more expensive is the cause of inflation.

Wizard01475 t1_iv0i4vw wrote

While I agree there could be more. They have opened new ones. As recently as 2022

https://www.eia.gov/tools/faqs/faq.php?id=29&t=6

When there is profits to be made companies will build the infrastructure.

mr_Feather_ t1_iv0i5f8 wrote

Ah, we're talking about gasoline here, not liquid gas

unclickablename t1_iv0ja70 wrote

If you call oil gas, what do you call gas? Which one is measured in mouthfulls?

ArvinaDystopia t1_iv0o8fv wrote

Meanwhile, in Western Europe, the light blue bar is by far the biggest.

GranPino t1_iv0pc6c wrote

That would be a normal year. But when there is lack of refining capacity, the margin skyrocket.

40for60 t1_iv0vmdg wrote

They weren't building them prior to Biden either. The Philly plant decision to not rebuild was made during the Trump admin.

40for60 t1_iv0w3ln wrote

They are not shuttered, they are at a 7 year high utilization % of 94%.

40for60 t1_iv0wa37 wrote

and electricity. The US also doesn't have a VAT and the bottom 50% of the earners contribute only 3% of the income taxes.

40for60 t1_iv0wjj6 wrote

you mean tax the poor more, right? We should do what Europe does, tax the poor then give the rich kids free college, right? Levy a large VAT and high taxes on the energy because that is great for the poor.

sandee_eggo t1_iv0yo2w wrote

I had someone telling me irl yesterday that oil is a huge component/cause of inflation. While that makes common sense because we use oil to make and distribute so many products, oil prices are relatively low in America, and things like housing and health care make up a huge part of our household budgets. I mean, housing is like 30% of our budget.

drawkbox t1_iv10u6q wrote

Exactly.

Oil/gas is also the most damaging in increasing inflation because it affects the fulfillment of all goods across the board.

Oil/gas cartels have a massive lever on inflation they can use to extort the world, which they do on the regular and especially right now.

drawkbox t1_iv113cx wrote

Oil/gas cartels work hard to control the amount of refineries down as well as take out leases they never utilize. Then they blame others and other factors for "lack of refinery capacity".

Smaller amount of refineries and fewer companies that control production of refineries that control those, keep the price of gas high or the margins tight, that is desired by the oil/gas cartels the most out of anyone.

EddiesGrandson t1_iv13w8j wrote

This is absolutely not what the little Joe Biden stickers say…..

amanamongbotss t1_iv142ro wrote

Oh this actually is adjusted for inflation.

But yea I believe oil does work it’s way into inflation pretty heavily, especially in public sentiment about it (gas prices are strong correlated with the sitting presidents approval rating- they’re almost identical).

I think inflation is also lower here in the US than many places abroad, and yea- while oil is a big chunk of that we have a lot of other things contributing too. Cost of wheat products for example. And I think the microchip shortage and other supply chain stuff as well…

starrdev5 t1_iv14amn wrote

That means ones that are open are at 94% utilization practically max refining capacity. That’s a sign of a refinery capacity shortage.

40for60 t1_iv15czv wrote

yes, one of the issues is the large refinery in Philly that blew up and they aren't going to rebuild it because the forecast is for consumption to decline. EV's are nearly 20% of new car sales in CA now The reason why gas prices went up so fast was due to the vaccine deployment going so smooth which made a sudden demand surge and outpaced the ability for the refinery's to ramp up, also North Dakota was slow to pump oil due to a really cold Jan/Feb then labor shortages.

starrdev5 t1_iv17552 wrote

You’re not wrong about your other points but specifically total refining capacity is operating at 1 million barrels of oil a day less than pre-covid.

Here is a list of refineries that shut down since Covid. Some of the shutdowns will cite things other than Covid that did them in like hurricane repairs and equipment maintenance costs, but refineries took big losses in 2020. It’s because of those big operating losses that their balance sheet couldn’t withstand the later operating losses.

40for60 t1_iv18tz6 wrote

Qty is down but not because systems are idle as the first person I responded to insinuated but because Philly is gone and the rebuild of Husky,due in 2023, and others isn't complete.

Neither-Idea-9286 t1_iv1bqee wrote

Corporate profit should definitely be a contributing factor yet it’s no in there.

Atthis t1_iv1egyq wrote

This is misleading. From the graph it appears that there are wide swings (+/-100%) in the refining costs, while in reality the costs are pretty constant year to year. I believe the refining part of the graphs includes the profits of the companies too, not just the costs.

40for60 t1_iv1hhpr wrote

Explain in detail please along with timelines.

marsh55116 t1_iv1hu71 wrote

What type is that oh great mind reader

wingfield65 t1_iv1irdt wrote

Refineries have to purchase crude oil.

wingfield65 t1_iv1j8kn wrote

Crude costs fluctuate because price of crude is based on supply and demand

wingfield65 t1_iv1jg6k wrote

The market

wingfield65 t1_iv1jtqj wrote

Profit margin equals revenue minus expenses. The above plot shows only expenses.

wingfield65 t1_iv1kmjd wrote

Refineries purchase crude on open market. Crude price function of supply and demand.

Ed_Chambers_PP t1_iv1knla wrote

The type of guy who gets down voted in a data visualization sub for saying obviously incorrect and stupid things because of his lack of understanding on how markets work.

wingfield65 t1_iv1kwm2 wrote

Cost of crude represents majority of refinery costs.

onetimeuse789456 t1_iv1l7u2 wrote

"Marketing" in the context of gasoline usually refers to physically getting the product to market, not advertising. While advertising may included in total marketing costs, it plays a very minor role.

There are entire "petroleum marketing" companies that buy product from refineries to sell to places like gas stations. They're not putting up billboards advertising Exxon refined gasoline. Rather, they are essentially acting as middlemen to efficiently connect suppliers with consumers.

marsh55116 t1_iv1lf88 wrote

I don’t care if I get down voted.. But I can cite multiple articles where people give him credit for lowering gas prices.. If he didn’t cause them to rise, then he didn’t lower them.,

Biden himself said he took credit for the ‘em going down..

He said Putin was responsible for them going up..

Your “data is beautiful” is just a biased cover for the administration..

It’s like the Fact Checkers.. Everyone assumes they are neutral and have no agenda..

And the reason I got down voted is because you are all in an echo chamber and not used to hearing views you disagree with..

All data is interpreted through a particular lens.. Even my lens.. I acknowledge my biases, do you??

tico_pico t1_iv1n3j4 wrote

When people say oil "prices" they typically mean crude oil futures. Crude oil futures are contracts for the future delivery/sale of a certain specification of oil at a certain location. In the case of WTI, widely considered the main US benchmark and most liquid commodity futures contract in the world, that specification is crude that meets the specs outlined here:

https://www.cmegroup.com/content/dam/cmegroup/rulebook/NYMEX/2/200.pdf

and is delivered into tanks in Cushing, Oklahoma.

Every month futures prices are tied to the physical supply and demand situation in the US because if futures prices get too expensive/cheap relative to the futures people will buy/sell crude and deliver it to Cushing. For example, say a ton of speculation drives futures to 120/bbl 3 weeks before contract expiration but there is actually tons of physical crude available and the price really shouldn't be that high. Say prices in Midland, Texas are only 90/bbl and this reflects the "real" price of physical crude based on what people around the world are willing to pay for physical barrels. Crude shippers/traders will start buying crude in Midland while simultaneously selling futures for delivery in Cushing. By doing so, those traders just locked in a 30/bbl profit minus whatever is costs to get the crude from Midland to Cushing and store it for a couple weeks. They will then ship their crude to Cushing, wait 3 weeks, and delivery against the sale contract that they agreed to at 120/bbl. You can see how in aggregate everyone doing this will bring down that futures price from 120/bbl to roughly 90/bbl.

LooseEarDrums t1_iv1nsa3 wrote

So, that is mostly just jobbers.

Ed_Chambers_PP t1_iv1o87b wrote

I acknowledge that I was correct on assuming what type of person you are. Sorry that facts don't align with your feelings. If this is an echo chamber (driven by quantifiable data), then why are you here? Go to r/conservative where facts don't matter.

marsh55116 t1_iv1spux wrote

You’re charming.

[deleted] t1_iv1sqvr wrote

[removed]

marsh55116 t1_iv1tzhj wrote

It isn’t “just data” you literally made it partisan from the get go!

Ed_Chambers_PP t1_iv1ubaj wrote

Yes, by responding to your stupid political comment I made it political. Great job smart guy.

Ed_Chambers_PP t1_iv1uh81 wrote

Being overly polite to idiots got us to where we have to constantly hear from people like you thinking you know what you are talking about. If you need a safe space, go somewhere else.

marsh55116 t1_iv1ulf3 wrote

Okay so you insult.. You only call it stupid because you disagree with my opinion.. The Left gave Joe Biden credit for it going down.. He didn’t cause it and didn’t lower it..

marsh55116 t1_iv1ure7 wrote

“Party of love, Compassion, Unity, and Tolerance” strikes again!!

Ed_Chambers_PP t1_iv1vikr wrote

He literally has taken actions to lower gas prices which were inflated due to decreased production and price gouging. So the facts are he didn't cause the high prices but has worked to lower them. You just aren't capable of looking past your bias to understand facts.

Based on how much you are down voted, I think everyone else besides you was smart enough to figure this out.

"Mr. Biden’s decision to order the release of 15 million additional barrels of oil from the Strategic Petroleum Reserve is designed to address the immediate worry of rising gas prices, which was exacerbated further by Saudi Arabia’s recent decision, in concert with Russia, to cut oil production. In total, 180 million barrels of oil have been released since Mr. Biden authorized the use of the reserve in March."

Ed_Chambers_PP t1_iv1vmxg wrote

Cry more about it.

TiredTim23 t1_iv1vzc7 wrote

Here you go. I will say; 1. Rejoin Paris Climate Agreement likely didn't change the price unless it spiked future markets. 2. Odiously Biden isn't responsible for Russia invading Ukraine.

marsh55116 t1_iv1xyg4 wrote

Touch grass pal! There are actual people behind these screens.

40for60 t1_iv1y26j wrote

Did Biden control the weather in ND too?

Also why didn't Trump step in and use his magic in Philly to ensure the refinery gets rebuilt there?

Some of you are the most gullible monkeys around.

Ed_Chambers_PP t1_iv1yi1m wrote

Take your stupid posts back to r/nofap and r/conservative where you belong. Adults are talking here.

Hazzawoof t1_iv1yv60 wrote

OK let me address your strawmen arguments one by one...

-

truly poor people aren't driving anyway. To the extent it affects the working poor, there are other policy options to make up for it. Pricing in the externalities of your energy use doesn't have to happen in a vacuum. Public transport can be subsidised, EVs can be subsidised, tax transfers can be used.

-

Europe taxes the poor to send their rich kids to college? Yes, many countries in Europe have high gas taxes. They also have lower levels of inequalities than the US... And guess what, the people on lower incomes can afford college too! Despite the "land of opportunities slogan" the US has less social mobility than many of its European peers.

-

Do you think global warming is great for the poor? The US is a huge carbon emitter because it does not price in its energy use externalities. Yes it will affect the poor but fuck guess what, the extras taxes can be redirected for their benefit. Win-win.

kilog78 t1_iv20j48 wrote

But isn't that captured in the green bar?

40for60 t1_iv20pwv wrote

-

I work in the clean energy field and drive EV's so I don't need a lecture from someone who most likely does neither.

-

Lets look at Germany, at age 12 they test the kids to see who is college material and then split the the chosen ones into AP like systems so by the time they are 18 they have already completed a lot of what we would deem college materiel. Should we start doing that here? Deny the poor, refugees and immigrants the opportunity to go to college?

-

In Europe all of society pays the higher regressive VAT and energy, which include electricity, taxes and this is then used to pay for things like college for the chosen ones.

If we charged the poor more for electricity or fuel how would this speed up the conversion to green energy? I'm really curious how the little bit would could squeeze out of the poor will accelerate the testing on deep water wind turbine platforms? Or overcome the BLM hurdles for the Choke Cherry project?

Dark_Marmot t1_iv22pwv wrote

OK biding some copy pasta here this document mainly outlines how oil is traded as a future but still on a daily basis per market guidelines and basically outlining how its really Hedging instead straight Speculation. OK fair, that is not quite why I asked. It's the argument that these market factors some how don't drive what the barrel price might be 6 months from now or the amount of buys and puts that are in place so investors are not losing their shirts. I think some here are just trying to dispell this perception that Presidents have a magic wand that any one can wave to have a $1 per gallon or more change instantly or in months. Even releasing 200M barrels into circulation has a mere change in cents.

tico_pico t1_iv24h7t wrote

Copy pasta? What are you talking about? Having a hard time even understanding what your response is trying to convey so I don't have a response to you.

Hazzawoof t1_iv2ahdg wrote

- I don't own an EV nor any other car. I catch (electric) public transport

- Why is this turning into some ill-informed conversation about the merits of paid/free university? It has little to do with gas taxes. But since you insist on digging that hole... Socialised education and health services kinda conclusively are effective at reducing poverty and income inequality. Go look up the Gini index. Germany and Europe in general is way in front of the US in this regard.

- Do you have any economics background? Go look up the concepts of supply and demand, and externalities. Increasing the price of 'dirty' energy makes people less likely to use it and use clean energy sources instead. Clean energy producers are incentivised to invest more as the competitive advantage of dirty energy producers (not paying the cost of their externalities) is reduced/negated. Further, tax revenues can be used to subsidise clean energy R&D.

Lastly, I don't even think taxing gas is the right solution. Introducing a proper cap and trade emission trading scheme is what the US/ world really needs.

jinxies1 t1_iv2aznt wrote

You Are All Wrong !! The president spins in his office 3 times then he needs to clicked his heels 3 times. Follow by meeting with the shamens where they share a ceremonial gummy before leaving this dimension to meet with the gas gods. He must high five the gas God ExxonMobil in that dimension before the trip is over and he thrusted he back to our dimension.

It's super important that he spins 3 times or he has to do this all over again and so help us if he forgets . The gas prices increase by 4 dollars.

I have insider knowledge this is why sometimes all the presidents age so much. It's stressful job and journey to reach the gas God every midterm. ...

..

..

.

Do I even need to say /s If you think I was serious This is your clear sign you are super susceptible to delusional thoughts and your probally in a cult.

40for60 t1_iv2gbwp wrote

MN has a higher HDI then both Germany and Europe does and a number of other states do to. As far as GINI goes Ukraine has a better index then almost all of the Euro's so how relevant is the Gini? but Ukraine's (along with most countries in Europe) have a GDP PPP then Mississippi, there is massive inequality in Europe unlike the the US, there is a big difference from Germany to Poland to Ukraine. But back to EV's and clean energy, straight up you don't know what your talking about. Beyond just big OEM mfgs like Ford and GM the first tier suppliers like Dana/Spicer, Magna, Borg Warner etc.. are all making massive investments in EV tech, problem is outsiders like yourself don't see it because they aren't making Tik Tok videos every 5 minutes to appeal to children. MISO laid out their plans for the massive expansion of the grid earlier this year is anyone talking about that? The largest wind farm in the country, which is being developed by a Republican Billionaire and could produce 1% of the countries electricity is starting to be built out and the deep water wind turbines paired with the new 15/16/17 MW turbines will start being produced in scale post testing in 2025 then deployed off of both coasts.

So I'm baffled by people who think nothing is getting done and that taxing the shit out of poor people or a carbon tax (that would never pass) would move the needle. The Chokecherry farm has been in development for 15 years, for all the people that are complaining nothing is being done why aren't they doing something? Why isn't AOC sponsoring a massive training program in her district for the 10's thousands of union jobs that will be needed for the massive offshore wind industry?

https://en.wikipedia.org/wiki/List_of_countries_by_income_equality

TiredTim23 t1_iv2iabw wrote

Pause. You said, “Explain in detail please along with timelines.” I gave you exactly that. Dates of when the Executive branch did things the affected the price of crude oil. I’ve cited you source that is exactly what you asked for.

I’m not a Trump fan. I’m not quite clear on what your saying he did wrong, I’ll just agree. But I think it’s telling how you point to something Trump did that caused gas prices to go up. Then pretend like POTUS can not have effect of gas prices.

Odiously there are things outside of the president’s control that change gas prices. I called out 1 of them in the graphic I cited. My point is there are things within the presidents control that affects gas prices. And I’ve have shown you a source of things he’s done. And it’s seems like you agree with my premise.

40for60 t1_iv2jcnr wrote

that wasn't details that was a meme.

nothing about the the refineries that were taken offline during Covid for upgrades or Philly which isn't being rebuilt. Nothing about the cold weather in ND, the Husky refinery or the labor shortage in the Bakken. Outside of releasing the strategic storage there isn't anything the President does that affects the price short term. The graphic isn't a serious one.

40for60 t1_iv2kt81 wrote

This is the third straight year that submittals have exceeded the previous all-time high, reflecting an acceleration of the resource transition. This acceleration is a trend identified in MISO’s Renewable Integration Impact Assessment (RIIA), among other sources. “At this point, we are experiencing exponential growth in the queue,” Andy Witmeier, director of resource utilization at MISO, said. “The current applications continue to be heavily weighted with renewables and standalone storage requests again tripling the amount submitted the previous year.”

Supply and Demand doesn't really work at the consumer level for grid provided energy and most people don't have the ability to produce their own. Its good that some people started to work on these problems decades ago while others were doing nothing.

Wizard01475 t1_iv2yghv wrote

So the increase cost in crude is identified both in the cost for crude and for refining it?

wingfield65 t1_iv2z6nq wrote

yes - when price of oil goes up the cost for a refinery goes up for both feedstock and cost of refining. cost of refining will go up because utility costs go up.

wingfield65 t1_iv2ze2s wrote

That’s correct. That’s why the height of the green bar varies over time.

TiredTim23 t1_iv2zkbz wrote

Keep moving the goal posts you’ll be right eventually. My point was never about short term prices, but prices overall. The timeline I shared was created before the things you mentioned happened. If you want to disprove the timeline I shared you either have to prove A) those things didn’t happen, or B) They didn’t affect the price of gas.

In general, what is disingenuous about the argument is the difference between the following statements: 1. ‘The president doesn’t control the price of gas.’ That’s true. 2. However, ‘the president can affect the price of gas.’ That is also true. The president does not decide the price of gas when he wants. But can change regulations that affect production costs.

kilog78 t1_iv2zut0 wrote

Sorry if I’m being dense, but shouldn’t the cost to refine remain relatively constant whether crude is $50 or $100ppb? Labor, other inputs, maybe regulation would change the cost, but otherwise not related to the cost of crude.

wingfield65 t1_iv3aovb wrote

there's a utility cost to refine crude. utility prices go up when cost of hydrocarbon goes up. I just resigned my electric contract recently and my cost went from 12c/kWh up to around 19c/kWh. that said, agree that the other costs should remain fairly constant over time.

Mahameghabahana t1_iv4frxs wrote

Go for net profit then.

phdpeabody t1_iv5d8au wrote

There's no bigger oil/gas cartel than the US Government.

ThePandaRider t1_iv5hd6l wrote

Everything gets more expensive because of inflation. Inflation is a currency losing value, mostly because the money supply has been expanded. If there is more oil and the demand for oil stays the same the value of oil decreases, if there is less oil and the demand for oil stays the same the value of oil increases. The same thing happens with everything, including currencies. If the supply of dollar is drastically increased from $16trillion to $21trillion in a short timespan then the value of dollars relative to everything should drop. And it has started to drop, we just don't know where it will settle.

[deleted] t1_iv6zd1l wrote

[deleted]

[deleted] t1_iv9hokv wrote

[removed]

Spook404 t1_iviu4y8 wrote

I'm so used to hearing him called Biden or Brandon instead of Joe I thought you were calling him the wrong name, like his name is actually Jim Brandon or something

USAFacts_Official OP t1_iux59g7 wrote

Source: US Energy Information Administration

Tools: Datawrapper, Illustrator

This is from an article on the Strategic Petroleum Reserve