Submitted by cyberentomology t3_y85vg6 in dataisbeautiful

Comments

cyberentomology OP t1_isy6zot wrote

Southwest is posting their Q3 results next week... Will be interesting to see what theirs looks like as their business model is very different.

Chickensandcoke t1_isyqr9c wrote

Why is their tax % so much different than United’s?

cyberentomology OP t1_isyqzks wrote

Not entirely sure - there may be state and local taxes involved, or they have significant operations somewhere that has a higher tax rate.

cyberentomology OP t1_isyr8tl wrote

Not offhand, but I can throw one together pretty quick. They may account for things a bit differently, but I’ll check it out.

HipWithTheTimes t1_isysb0n wrote

Why is it always airlines specifically

[deleted] t1_isyu1mu wrote

[deleted]

cyberentomology OP t1_isyvym4 wrote

It’s up.

I’ll probably do Lufthansa next week after they release quarterly.

cyberentomology OP t1_isyw27n wrote

Why is what airlines?

[deleted] t1_isyxeck wrote

[deleted]

cyberentomology OP t1_isyy4rm wrote

Just like RyanAir, the report is pretty lean on frills 🤣

skyecolin22 t1_isz2a3d wrote

Are they paying state taxes on jet fuel that they produce through their refinery?

cyberentomology OP t1_isz3hch wrote

Most likely, but that would be whatever the local state tax is at the point of purchase

cyberentomology OP t1_isz3muw wrote

Yeah, that was a surprise to me too. vertical integration FTW

cyberentomology OP t1_it01zw8 wrote

Good catch! I wasn’t fully paying attention when typing out the title. Can’t even blame autocorrect.

cyberentomology OP t1_it022pe wrote

delta is pretty good about lots of details in their financial quarterlies.

[deleted] t1_it028f6 wrote

[removed]

juan-de-fuca t1_it09nuk wrote

I’ve always wondered how much their bottom line is impacted by hedging fuel price fluctuation. They must be huge into futures and swaps.

Dude_Hold_My_Bear t1_it18fy1 wrote

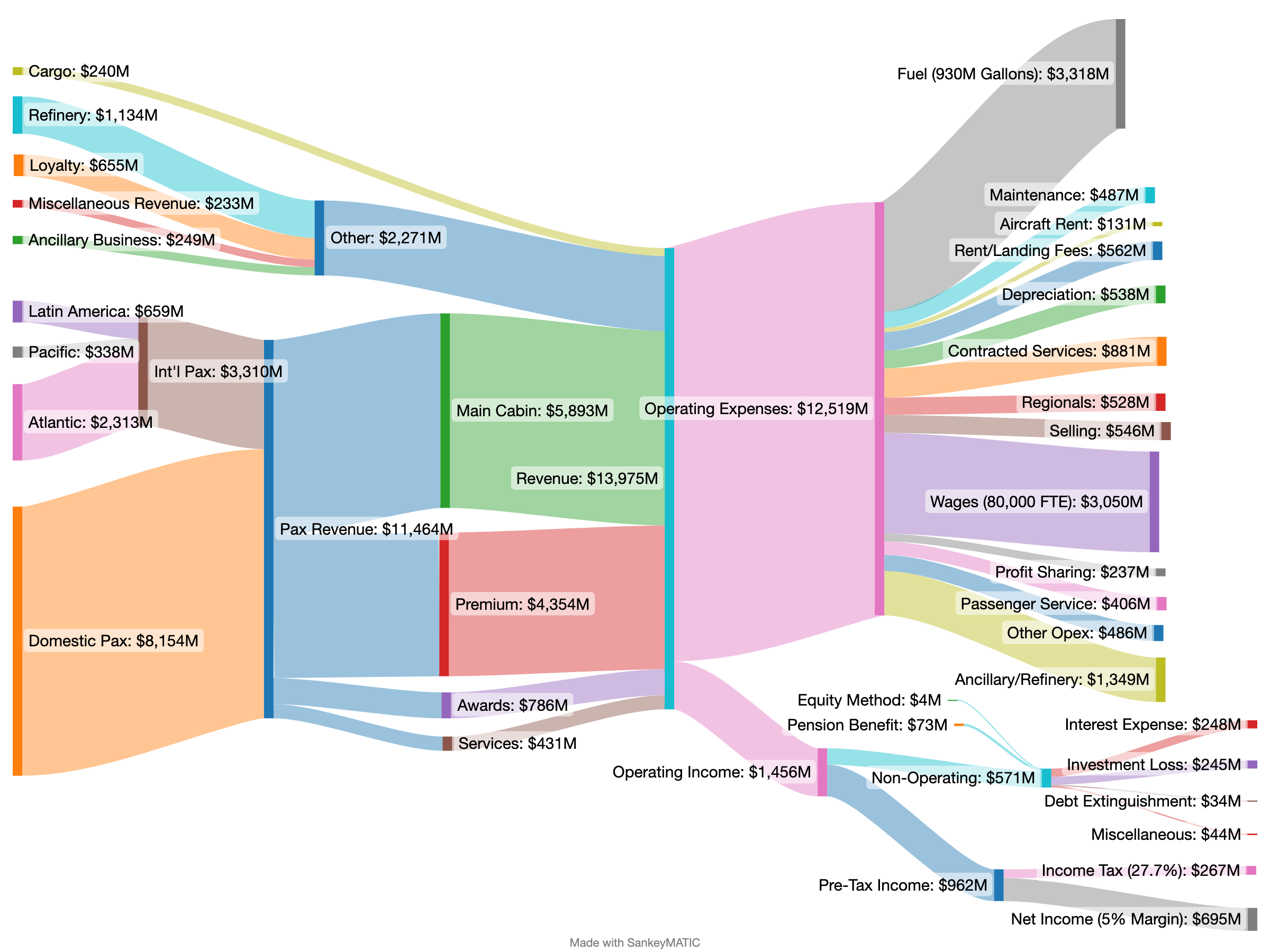

Almost 13B in income and only a net income of 695M. Operating income at 1.4B, and while I'm not a finance guy, I feel like 695M net isnt very good. Maybe I don't understand this (open to correction), so feel free to correct my understanding.

cyberentomology OP t1_it19ncj wrote

It’s a high volume, low margin business. Any net income that is positive is a good thing.

The numbers from a year ago are terrifying.

Lufthansa does similar volume and lost money in the first half of the year.

cyberentomology OP t1_isy6m33 wrote

Data Source: DAL 22Q3 Financial Results (October 13, 2022)

Tool: SankeyMatic

Some Interesting Observations: