Submitted by cyberentomology t3_y85vg6 in dataisbeautiful

Comments

skyecolin22 t1_isz2a3d wrote

Are they paying state taxes on jet fuel that they produce through their refinery?

cyberentomology OP t1_isz3hch wrote

Most likely, but that would be whatever the local state tax is at the point of purchase

NerdyDan t1_isz2148 wrote

I had no idea delta had their own refinery

cyberentomology OP t1_isz3muw wrote

Yeah, that was a surprise to me too. vertical integration FTW

cyberentomology OP t1_isy6zot wrote

Southwest is posting their Q3 results next week... Will be interesting to see what theirs looks like as their business model is very different.

[deleted] t1_isyqqdu wrote

[deleted]

cyberentomology OP t1_isyr8tl wrote

Not offhand, but I can throw one together pretty quick. They may account for things a bit differently, but I’ll check it out.

[deleted] t1_isyu1mu wrote

[deleted]

cyberentomology OP t1_isyvym4 wrote

It’s up.

I’ll probably do Lufthansa next week after they release quarterly.

[deleted] t1_isyxeck wrote

[deleted]

cyberentomology OP t1_isyy4rm wrote

Just like RyanAir, the report is pretty lean on frills 🤣

Chickensandcoke t1_isyqr9c wrote

Why is their tax % so much different than United’s?

cyberentomology OP t1_isyqzks wrote

Not entirely sure - there may be state and local taxes involved, or they have significant operations somewhere that has a higher tax rate.

HipWithTheTimes t1_isysb0n wrote

Why is it always airlines specifically

cyberentomology OP t1_isyw27n wrote

Why is what airlines?

[deleted] t1_isz9dl0 wrote

[deleted]

skotman01 t1_it01nr2 wrote

Not to nit pick…Airlines has a space in it when referring to the company name.

Thank you for this, I’ll be sharing it internally because it definitely helps explain where money comes and goes.

cyberentomology OP t1_it01zw8 wrote

Good catch! I wasn’t fully paying attention when typing out the title. Can’t even blame autocorrect.

[deleted] t1_it028f6 wrote

[removed]

cyberentomology OP t1_it022pe wrote

delta is pretty good about lots of details in their financial quarterlies.

juan-de-fuca t1_it09nuk wrote

I’ve always wondered how much their bottom line is impacted by hedging fuel price fluctuation. They must be huge into futures and swaps.

Dude_Hold_My_Bear t1_it18fy1 wrote

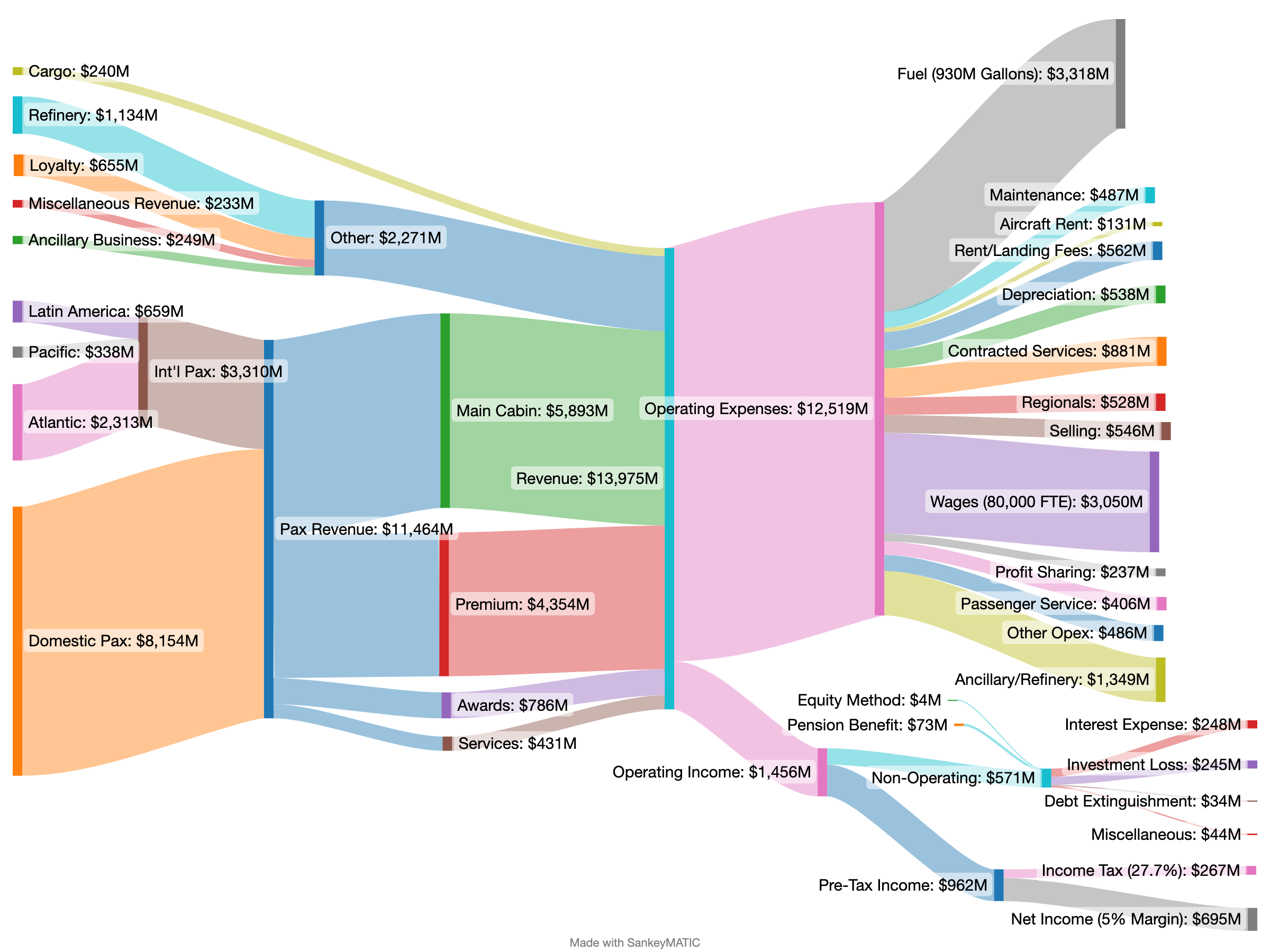

Almost 13B in income and only a net income of 695M. Operating income at 1.4B, and while I'm not a finance guy, I feel like 695M net isnt very good. Maybe I don't understand this (open to correction), so feel free to correct my understanding.

cyberentomology OP t1_it19ncj wrote

It’s a high volume, low margin business. Any net income that is positive is a good thing.

The numbers from a year ago are terrifying.

Lufthansa does similar volume and lost money in the first half of the year.

cyberentomology OP t1_isy6m33 wrote

Data Source: DAL 22Q3 Financial Results (October 13, 2022)

Tool: SankeyMatic

Some Interesting Observations: