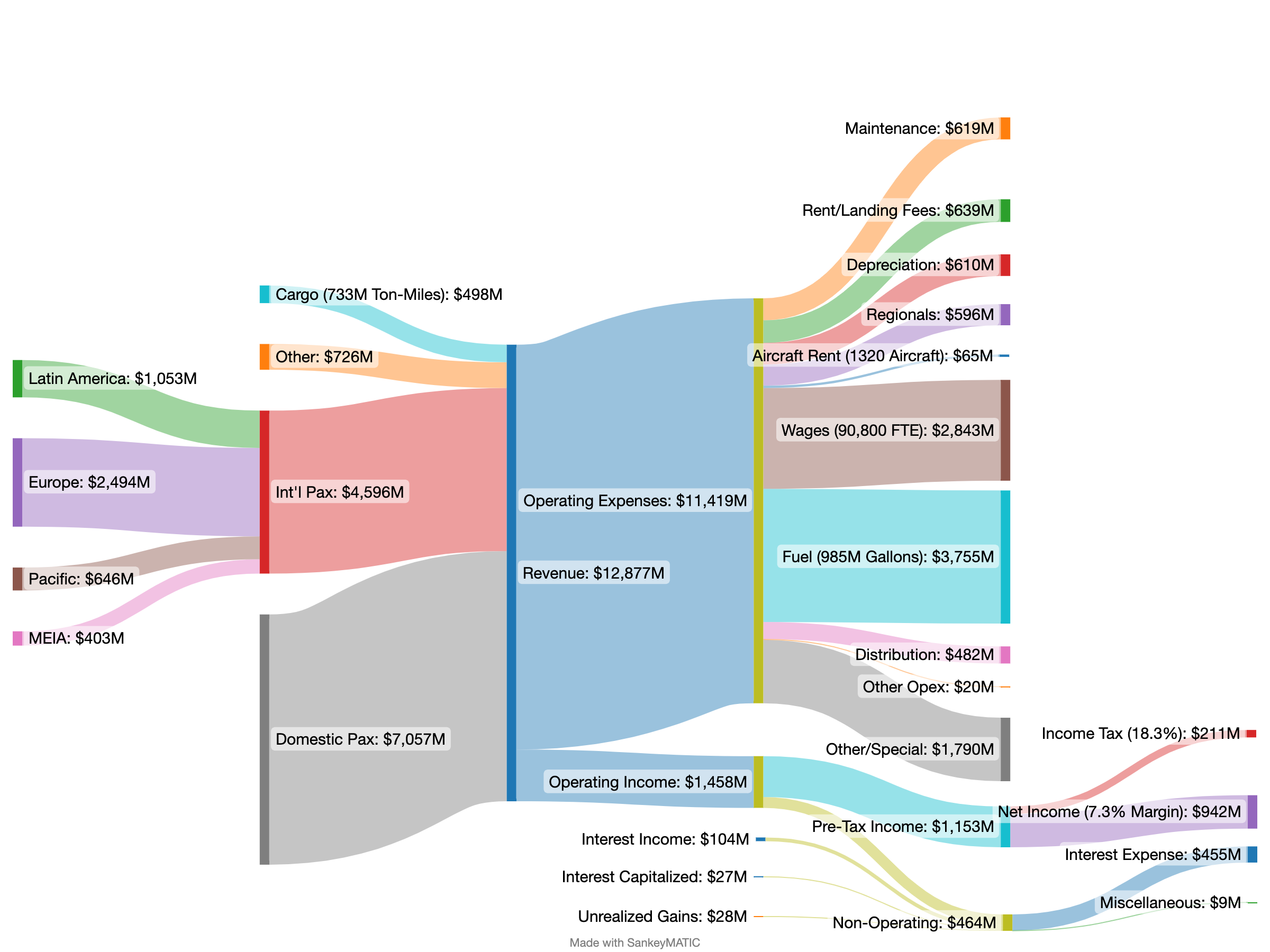

Submitted by cyberentomology t3_y84lo7 in dataisbeautiful

Comments

HobbitFoot t1_isy0l5k wrote

Where is United mileage program? United has effectively made the argument that its mileage program is worth more than the company as a whole.

HobbitFoot t1_isy0pfr wrote

That is really funny that Texas has the highest gas tax.

ihavethebestmarriage t1_isy1bwe wrote

would be interesting to see how the revenue splits out by class of seats.

I've heard that first and biz class fares far exceed coach fare revenues... but it's hard to believe

Accidental-Genius t1_isy1p7j wrote

I don’t feel as bad for accidentally taking the cloth napkins anymore.

FormerKarmaKing t1_isy886i wrote

Maybe you meant MENA (Middle East North Africa) instead MEIA? But nice work overall.

cyberentomology OP t1_isy8ovh wrote

Middle East, India, Africa - that’s how United breaks it out.

Sheyvan t1_isy915p wrote

Meia is Middle East, India, Africa i think

cyberentomology OP t1_isy91le wrote

United doesn’t break it out in their reports (but Delta does, I just posted that one). Would definitely be interesting to see how that breaks down between airlines.

Delta’s passenger revenue is about 50% main cabin, 40% premium, and the rest is award travel and travel-related services.

cyberentomology OP t1_isy97sn wrote

They don’t get into the specifics in their financials. delta does. Loyalty program revenue is usually buried in the “Other”.

cyberentomology OP t1_isy9t3q wrote

Right?

The highest state jet fuel excise tax in the nation is Kansas at 26 cents (followed by DC at 23.5, Arkansas at 22.8, and Indiana at 21). Although Atlanta also levies an 8.4% sales tax on it (half local and half state), which at current prices tacks on about 30-35 cents a gallon.

mmmmm_pi t1_isye9qy wrote

You're totally crushing these sankey diagrams. Thanks for making them.

As you prepared this, did you get a sense of what made up the "Other/Special" expense category? That could of course be anything and is so wonderfully vague.

cyberentomology OP t1_isyerkj wrote

The quarterly report didn’t really get into it much, but Other (income) is usually where things like loyalty programs, credit cards, commissions, etc come in (at least the parts that aren’t specifically related to travel redemptions). Delta gets into much more detail, perhaps United will do so in their annual report.

Other (expenses) is stuff like crew hotels and ground transportation, aircraft catering, etc.

Sankey diagrams are kind of low-effort, but they’re very well suited to things that flow, like rivers, and money.

cyberentomology OP t1_isyf58g wrote

American actually does a pretty nice summary sheet: https://imgur.com/a/lXdWfMu

guberhardt t1_isypqhf wrote

The fact that corporate income tax is only 18.3% catches my attention

mmmmm_pi t1_isyrjhm wrote

Thanks for pulling that up! Way above and beyond any expectations I had to answer a stranger's questions.

Surprising to see "crew hotels" plus things like catering and ground handling fall under this category. I realize hotels aren't a direct part of compensation, but it's such a meaningful operating expense that I would have expected it to get broken out, like some category of "Flight Support Operations" or some such thing.

cyberentomology OP t1_isyw6sq wrote

I’m sure the accountants have their reasons… and they probably don’t make any sense to us plebs.

cyberentomology OP t1_isywpnw wrote

That’s close enough to the statutory rate that is not particularly significant. They may have some capex that could offset some of their tax liability, or they may have overprovisioned in a previous quarter.

It could be that some of it is also subject to tax outside the US at a lower rate.

cyberentomology OP t1_isxxmu6 wrote

Data Source: UAL 22Q3 Financial Results (October 18, 2022)

Tool: SankeyMatic

Some Interesting Observations: