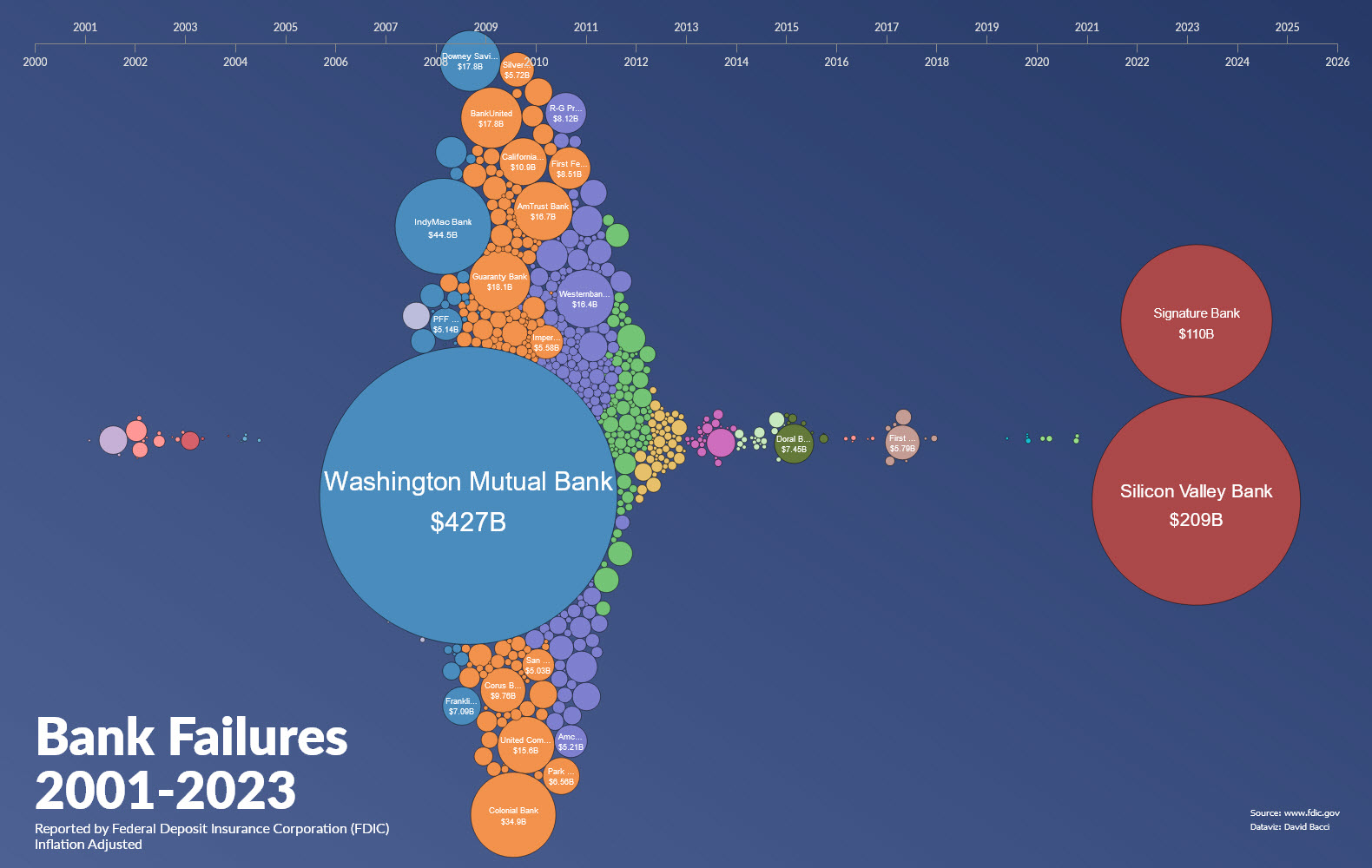

Submitted by dbacciPBI t3_11sbsbf in dataisbeautiful

Comments

elshizzo t1_jcd0cn9 wrote

We're just repeating history. Before Glass Steagall was put into law in the 30s, we had a financial crisis every ~15 or so years. Now we're back on that pace, stupidly

CerebralAccountant t1_jcd1iww wrote

Thank you so much for coloring and sorting by year! Those are extremely useful for understanding how many bank failures occurred in a certain period and their total amount.

arkeod t1_jcd4hc0 wrote

What would Crédit Suisse look like?

Kesshh t1_jcd94wp wrote

This is an awesome visual!

LatterNeighborhood58 t1_jcddh19 wrote

This is a awesome graphic OP. Do the colors carry any meaning?

Vipershark01 t1_jcdgdzc wrote

Wanna throw back Thursday and add the south sea company tomorrow?

vk6flab t1_jcdggaa wrote

I'm sorry, but why are you showing two failures when there are three - so far - in 2023.

> Three US banks failed within five days, the most prominent was Silicon Valley Bank (SVB), the largest bank to fail since the 2008 crisis. > > Two days after SVB collapsed, state regulators closed New York-based Signature Bank and last week, crypto-focused bank Silvergate announced it would have to wind down its operations. > > And there are warnings of more closures to come.

[deleted] t1_jcdh6xf wrote

kmmontandon t1_jcdhji9 wrote

Does Silvergate really count? It was basically a crypto inflated facade of a bank over the last five or six years. It’s actual value was pretty small once the bubble popped.

[deleted] t1_jcdif7f wrote

[removed]

time4donuts t1_jcdimns wrote

I think color is the year of the Bank failure

vk6flab t1_jcdjlhm wrote

Where do you draw the line as "counting", or not?

Marklar172 t1_jcdnl3c wrote

My one criticism would be that using bubbles over time makes it look like, for example, the collapse of SVB played out over ~2 years, even though it was more like 2 days.

StrugglingLifeform t1_jcdolk1 wrote

I haven’t seen a single one of these posts have a legend but all of them use different colors.

Metelex t1_jcdusyt wrote

So if I survive this one I get 15 years to prepare for the next??

hornyaustinite t1_jcdyhcj wrote

Credit Sus is the blue ... background

SpawnSnow t1_jcdyoag wrote

At silvergate from the looks of things.

Melodic-Fee-370 t1_jcdz4ym wrote

That’s what the colours are for! The size of the bubbles communicate the size of the bank

Melodic-Fee-370 t1_jcdzbcu wrote

I had no idea this many banks failed in ~2008. Most discussion about the financial crisis focus on Lehman Bros

Iaintnogaybear t1_jce1doa wrote

In my opinion, it should be adjusted for m2 (money supply). Inflation hasn’t gone up as fast as the money supply and I think it makes more sense to use that when comparing bank assets.

Miserly_Bastard t1_jce5z8m wrote

Yes, this! Inflation is the lazy man's adjustment. It works okay in the short term (good for Fed policymaking) but grossly overstates the utility of a dollar in the medium to long term.

TonyzTone t1_jce6pc1 wrote

Because Lehman was also huge and because it was so interconnected with so many other parts of the economy. If you notice, it’s not on here because Investment Banks aren’t really banks.

Otherwise, we should also be showing Fannie Mae, Freddy Mac, Bear Sterns, AIG, and more. 2008 was a next level crisis.

uthinkther4uam t1_jce766a wrote

Holy shit.

I was still in HS during the 08 recession so stuff like this didn't really come up on my radar, but I did NOT realize how many fucking banks failed in that timeframe.

[deleted] t1_jce89zm wrote

[removed]

porncrank t1_jcebj92 wrote

There's been a lot of attempts to display this information -- I like this one the best so far. It gives context and a sense of scale the others lack. Well done.

porncrank t1_jcebkjn wrote

Hey, if you fix the problem, and then there's no longer a problem, why do you still need the fix? /s

throwdroptwo t1_jcebzt0 wrote

Until the next ponzi scheme. Give it a nice name like desantis bank.

VestPresto t1_jcecncm wrote

530b in assets. Larger than the largest on this chart, but cause it's circles it wouldn't look too much bigger

Electrolight t1_jceg51p wrote

Oh my. I've heard variations of this uttered by former leadership. It hurts to have to explain.

dbacciPBI OP t1_jcekt93 wrote

Thanks. Colour is year of failure.

dbacciPBI OP t1_jcekxlz wrote

A legend with 20 colours would be quite ugly and not that useful in my opinion. However, I should have said that year is encoded as colour to be 100% clear on the chart.

Jakava t1_jcelel8 wrote

It's been interesting to see the evolution of this visual to something that actually conveys information well. Well done OP

spca2001 t1_jcessc8 wrote

It would be nice to add a section on what political party, person of influence , financial entity each bank fail was blamed for

Dazzling-Grass-2595 t1_jcex3fo wrote

Did the data start at 2001 or did the failure start there?

hawklost t1_jcexbif wrote

The US had a LOT of regional banks. Ones that were only in a single town or city. That means there was a lot of tiny failures that happened that were purely local.

dbacciPBI OP t1_jcexu8c wrote

That's just when my data starts.

grumd t1_jceyfkp wrote

I kinda think using diameter instead of area for the circles would make more sense. Because of the same reason why people struggle to understand that 18" pizza is more than two 12" pizzas. It's just not as intuitive for people. WMB here looks slightly bigger than SVB, but the numbers are more than twice as big.

123fourfive67eight t1_jcezvdj wrote

You could do the relevant color as the font color or background on the year, up top!

[deleted] t1_jcezx6p wrote

[removed]

snekbat t1_jcf02me wrote

Insert GTA San Andreas meme here.

dbacciPBI OP t1_jcf0erk wrote

Not a bad idea to be fair but the way Vega works, this would be a huge amount of work and I'm still not sure about the aesthetics of it. The interactive version has tooltips so it becomes pretty clear when hovering.

123fourfive67eight t1_jcf1fgc wrote

Ohh, didnt know it had an interactive version. Makes sense

123fourfive67eight t1_jcf1l1k wrote

Also nice post! Thanks

dbacciPBI OP t1_jcf1s62 wrote

Cheers mate.

[deleted] t1_jcf39p7 wrote

[removed]

nagi603 t1_jcf3ti2 wrote

Red. Just red.

IncomeStatementGuy t1_jcf6rm8 wrote

Wow, fantastic visualization!

dbacciPBI OP t1_jcf8un4 wrote

Thanks. Your work inspired me to create this in Power BI so thank you.

https://www.linkedin.com/feed/update/urn:li:activity:7039232737118978050/

IncomeStatementGuy t1_jcf9z7k wrote

Nice one! I need to try the tools you used. Were there any pain points in the creation process?

dbacciPBI OP t1_jcfb835 wrote

Lots lol! I publish all the code on my LinkedIn and Github so it is available to reuse and learn from.

QuarterSwede t1_jcfbbqi wrote

The tech industry is arrogant, thinks like they can do things differently, and are immune to complete failure. Obviously not.

kmmontandon t1_jcfc7eo wrote

How about "not having most of your assets in crypto"? You know, maybe having something that isn't just digital tulips?

[deleted] t1_jcfee29 wrote

[removed]

pierre_x10 t1_jcfg0dk wrote

How much would this chart change if it included banks that might have also failed, but were propped up by the federal government's TARP Act? Or it would there be a way to include this taxpayer cost to the chart, if it doesn't make sense to include those banks' corresponding sizes?

Ok-Lawfulness-5739 t1_jcfntf2 wrote

The Great Unraveling is here…. A Global Financial Crisis… Worse than 2008. 💀🔻

moczak9 t1_jcfpyji wrote

imagine what this will look like when we add Credit Suisse to the list hahha

IncomeStatementGuy t1_jcft8el wrote

Nice, I‘ll check it out

srv50 t1_jcfx3oe wrote

Systemic risk vs dumbass risk.

Nwcray t1_jcg33wu wrote

And small regionals.

Anyway, your point stands. There were something like 30,000 banks in the US in 1980, 15,000 banks in 2008, and 4,000 banks today. Consolidation has been unreal.

hawklost t1_jcg3ni4 wrote

It's actually always been fascinating to me, in the 40 years my mother has banked at the exact same location, it has been owned by 7 different banks.

Each time the smaller bank was bought out by a slightly larger one, that was then taken over by a third. Until now it is owned by one of the big 5 (has been for years now).

[deleted] t1_jcgbrsq wrote

[deleted] t1_jcgd21j wrote

[removed]

CityZen101 t1_jchtc6h wrote

Saw the original and thought this extra would be good.

Might be good to have a reference circle (maybe floating in the background)for the biggest existing bank for reference too.

But love it either way

cubenz t1_jcits05 wrote

Please do. I think it provides useful context.

insufferablyaverage t1_jcsbfg7 wrote

I wonder whst could have happened between 2008 and 2022 that would have possibly lead to banks between 100 billion and 250 billion to fail

dbacciPBI OP t1_jccvtls wrote

Here is a version adjusted for inflation. I should have added an explanation on the chart that colour represents the year.

Sources:

https://www.fdic.gov/

https://www.rateinflation.com/consumer-price-index/usa-historical-cpi/

All source data and code is on my GitHub

https://github.com/PBI-David/Deneb-Showcase/tree/main/Bank%20Failure%20Bubble%20Chart

Tools used: Vega, Deneb, PowerBI