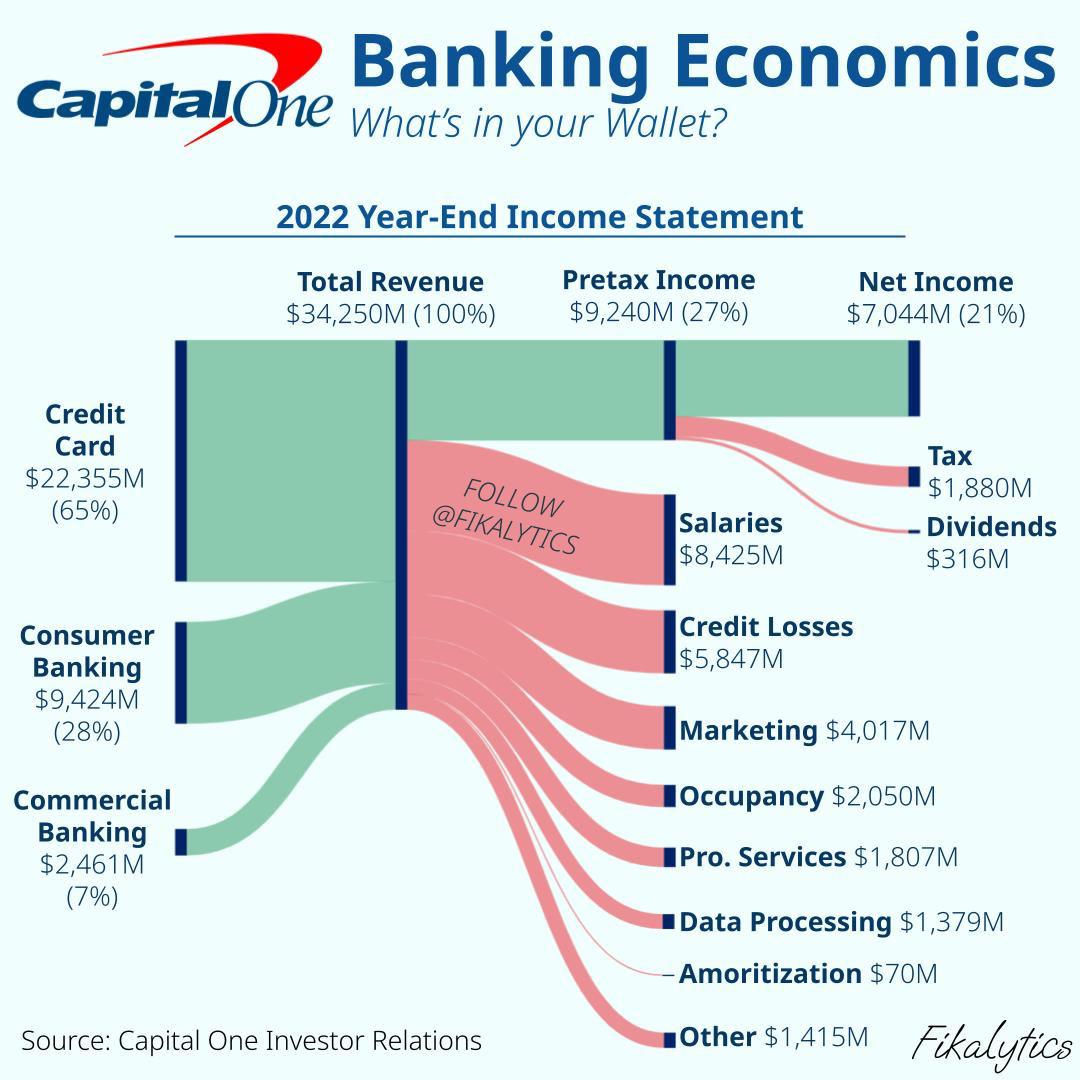

Submitted by Square_Tea4916 t3_11dw417 in dataisbeautiful

Comments

1714alpha t1_jab7c7e wrote

Paying a little over 25% in taxes on net income, seems better than many giant faceless corporations?

Square_Tea4916 OP t1_jab90ux wrote

It’s very nice of them.

reddituser7542 t1_jabap51 wrote

Your larger point is valid and stands. At the same time this may be due to compulsion and not by choice. If they could domicile in caymen and still offer financial services in US, they would.

Also, being a bean counter here, but the tax paid is little over 20%. Should be calculated as percentage of pre-tax income, and dividend is taken out of the net income after tax.

1714alpha t1_jabbwg1 wrote

True, should've counted pretax. I wonder what the other cheater companies are doing that Capital can't afford to do? Seems like they should be able to take advantage of as many scummy loopholes as the next 800lb gorilla. I don't believe for a moment that they pay one red cent more than they can get away with, or do it out of the goodness of their greedy little hearts.

Is this evidence of stronger corporate tax laws than we are generally given to believe? Or, more likely, is there other financial monkey business that can be done after this calculation that effectively reduces the total tax:profit ratio?

liberalboy2020 t1_jabcvh7 wrote

They're doing 5% APY for CD's now, so where's the interest fees paid to deposit customers go in the expenses?

wompwump t1_jabipgy wrote

Financial institutions usually report net interest revenue, which means that interest paid to depositors has usually been taken out of the top line. Eg, if I make $200 lending out deposits that I paid you $100 on, I’d report $100 in net revenue as the “top line” figure to focus on.

[deleted] t1_jabv5vl wrote

[deleted]

ErieSpirit t1_jabyer7 wrote

A couple of points:

-

That line item just says taxes, so more than just federal income tax. Could include payroll taxes, local taxes, foreign taxes. It also can include past year accruals.

-

One can't tell what they paid in federal income taxes, or what percentage, without seeing their 1120 tax return, which is not public.

-

I assume this graphic represents what is on their 10k SEC filing. This would be done with accounting standards such as GAAP. The IRS has their own accounting standards for tax purposes, which are different than GAAP. Their 1120 tax return may not reflect the same numbers as shown here.

nightb4xmas t1_jabzj5t wrote

nothing novel here in terms of Sankey presentation, but this would read better had it been done in $B

switch495 t1_jac3pid wrote

I really wish information was formatted like this in quarterly and annual reports as a standard

sls_atv t1_jac8rhs wrote

Can you add another layer, which breaks down revenue per LOB by source? Curious about breakdown for interest and non interest revenue forbeafh line of business and how that makes up the whole

Square_Tea4916 OP t1_jacfgdv wrote

Usually companies don’t include a lot of detailed information like that when they show an aggregated view.

Icy_Case4950 t1_jacjw8e wrote

The net income is lower than the salaries paid to its employees

cyberentomology t1_jackrpp wrote

That’s pretty standard.

sls_atv t1_jacnxde wrote

Oh I thought you made this graphic and had control of the data included, sorry

Square_Tea4916 OP t1_jacqfta wrote

I did but I’m limited to what’s shown in Capital One’s 10K SEC filing

Obvious_Chapter2082 t1_jadakhn wrote

That’s just their income tax expense. The actual income tax they pay might be much larger or much smaller than this

Most large corps have low rates mainly from R&D credits and stock compensation. I’d assume Capital one doesn’t have much of those, or they could just have a large reconciling item that raises their rate

[deleted] t1_jadauxg wrote

Obvious_Chapter2082 t1_jadb752 wrote

The foreign impact on ETRs really isn’t large anymore, since the US taxes global corporate income. I would just assume they don’t have a lot of R&D or don’t pay a lot of stock compensation

Obvious_Chapter2082 t1_jadbdym wrote

Once their 10-K is released, you can probably get a good guess from their current provision. But I agree, total income tax expense won’t even be close to the actual tax they pay

ErieSpirit t1_jadkami wrote

Yep, in another month I think we can read the tea leafs on their 2022 10k.

Square_Tea4916 OP t1_jab5bcr wrote

Source: https://investor.capitalone.com/

Tool: SankeyMATIC