Submitted by IncomeStatementGuy t3_11e106g in dataisbeautiful

Comments

[deleted] t1_jabuvu5 wrote

[removed]

IncomeStatementGuy OP t1_jabux7w wrote

It's a visualization of the income statement, not the cash flow statement.

arejay007 t1_jabuyhu wrote

You’re right and I’m a little drunk.

IncomeStatementGuy OP t1_jabv176 wrote

Enjoy while it lasts

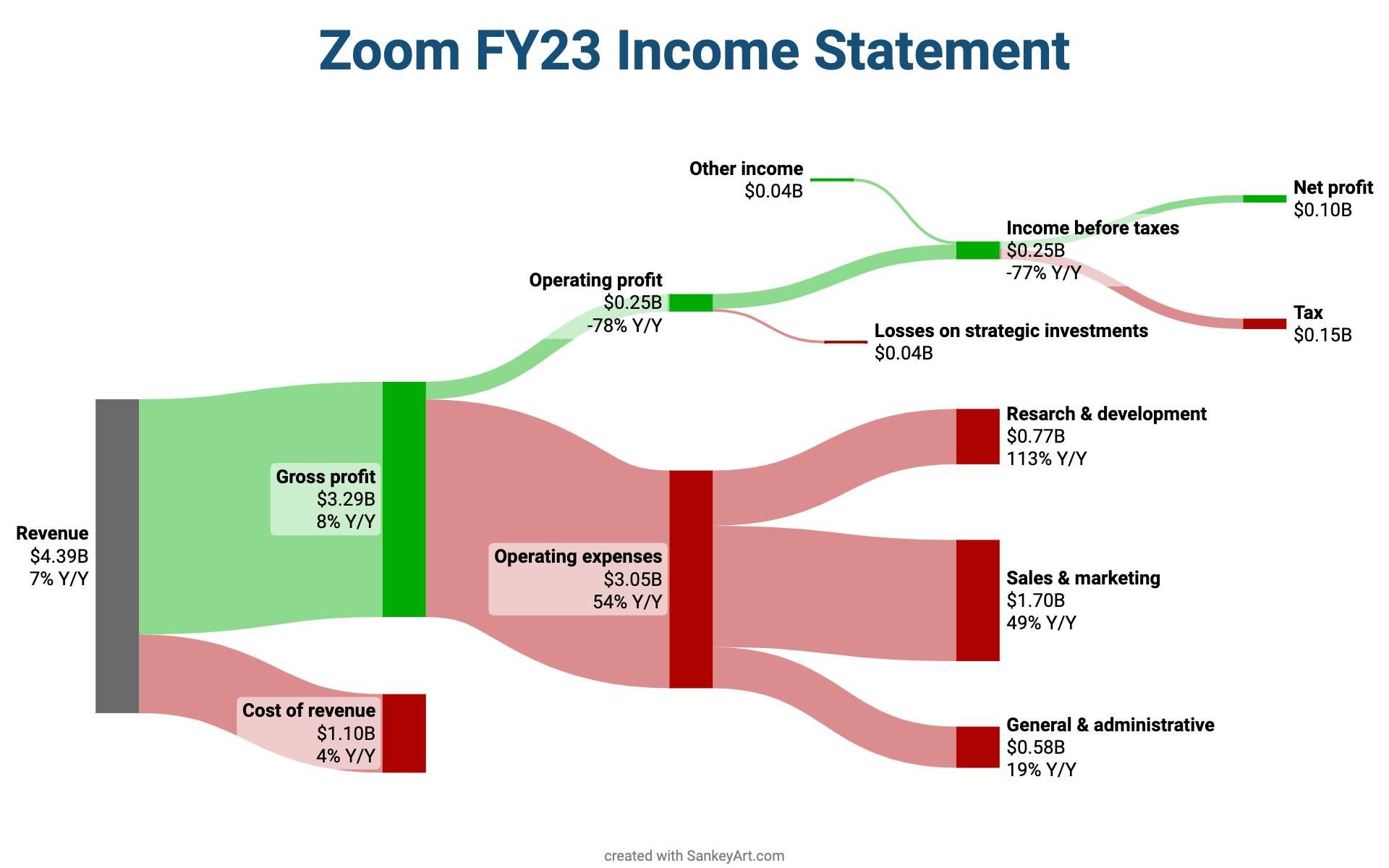

fh3131 t1_jabv6py wrote

Not great profits.

Also, *FY22

IncomeStatementGuy OP t1_jabvjns wrote

It's their fiscal year 2023 which ended on January 31 2023.

Confusing.. companies should just stick with January 1 to December 30 fiscal years if you ask me.

fh3131 t1_jabw46w wrote

Wow, I had never heard of a fiscal year ending on 31st January, thanks for clarifying

Skeptical_Minotaur t1_jabwh0h wrote

What’s the cost of revenue? That’s new to me.

IncomeStatementGuy OP t1_jabx6aw wrote

Cost of revenue contains costs that are directly needed to produce and distribute the product or service. For software companies, this contains for example server costs.

For an auto company that would contain the bill of material for the cars and the salaries of the manufacturing workers (but not the salaries of R&D engineers and management as they are not directly needed to produce the cars).

squirrelinthetree t1_jaby3yc wrote

I wonder what it tells us about a company when it spends more on marketing than on making the product itself.

damnsignins t1_jabyoxp wrote

That's how media works. There's a video floating around of Matt Damon on Hot Ones explaining how movie profits work. They have to spend at least as much money on marketing as they do on production and distribution, so if a movie doesn't make roughly a 4x return on its cost, it's a financial flop. Since Twitch has to spend a lot on paying streamers, they're operating revenue is thinner than most.

[deleted] t1_jabztnd wrote

[removed]

Nairne_ t1_jac4sjj wrote

That seems like a proportionally rather high tax bill?

silentorange813 t1_jac5men wrote

It makes sense if the company believes that it already offers a competitive product. The product lineup is also not as diverse as other industries like food or automobiles.

MrMitchWeaver t1_jac89bj wrote

This isn't "how" rather it's "how much"

MrMitchWeaver t1_jac8fyt wrote

Zoom is also a very simple product with few moving parts. It makes more sense that way.

originalusername__ t1_jacdd1s wrote

Paying more in taxes than you make in profit seems bad.

IncomeStatementGuy OP t1_jacdzt0 wrote

It shows which costs eat up how much of the revenue so I think it tells you how they make money.

However, revenue sources are not split up so I guess you have a point.

Nairne_ t1_jacezz5 wrote

I may not be a Fortune 500 CEO but if I were one I’d probably avoid doing that.

[deleted] t1_jach6em wrote

[removed]

Diiamat t1_jachika wrote

it says how they are spending the money but not how they are making it, is the revenue coming from subscriptions? advertising?

Obvious_Chapter2082 t1_jacho3l wrote

It’s because it’s not really their tax bill. There are a lot of things that can raise or lower income tax expense without changing the tax they pay, which can lead to super high or super low rates year to year

Obvious_Chapter2082 t1_jachr00 wrote

To be fair, they’re probably only paying a small fraction of that amount in taxes this year

[deleted] t1_jaciree wrote

[removed]

peopletrics t1_jacm736 wrote

Yeah, it’s not showing how they are making money but how they are spending money. One assumes that they make it from subscriptions but the data does not show it.

Redditaccount2322 t1_jacvdl4 wrote

Our FY ends in January 31st as well. It's fairly common in tech I believe for 2 reasons --

- Provides additional time to close enterprise deals after the end of the year - closing deals December 31st can be challenging, to say the least

- Reduces cost of accounting because most firms end their FY December 31st which is busy season for the big 4

Retail companies sometimes do this as well - or end a full quarter after March 31st instead of Dec 31st. Good luck to all the EY, PWC, DeLoitte people if every company ended Dec 31st lol

IMovedYourCheese t1_jad1ydy wrote

It depends. Lots of companies aim for 0 profit, because why pay high taxes and give money to shareholders when you can invest it back into the business instead? And it is even more relevant for high growth companies when additional customers are more valuable than money in the bank. Amazon famously did this for like two decades.

IncomeStatementGuy OP t1_jad2u4m wrote

You have a point. I should have added some sort of revenue stream info.

studmuffffffin t1_jadbufp wrote

Interesting tax burden. Most of the time in these charts it's like 10% of income. Here's it's over 50%.

vgsnv t1_jadwem3 wrote

I assure you there is nothing simple about the technical product that Zoom offers.

MrMitchWeaver t1_jady7ws wrote

I mean it needs few things to keep it running: engineers and servers. Am I missing something else?

Innovations would be covered by the R&D sector which is a different expense line.

Obvious_Chapter2082 t1_jae50qv wrote

There are a lot of things that can raise the effective tax rate without actually changing the amount of tax you’ll pay year to year. Anytime there’s a rate above 30% or so, that’s likely the case

[deleted] t1_jabuuah wrote

[deleted]